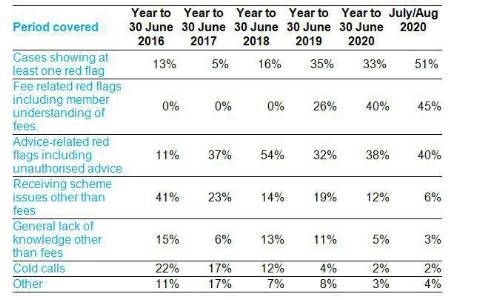

There has been a steep rise in red flag cases from just one in eight between 2015 and 2018 to around half of all cases in July and August 2020. The last two months cover those accessing their pension post the onset of COVID-19.

Factors triggering a red flag have changed. Those targeted with cold calls fell from 22% to 2% between 2016 and 2020. However, cases of high and misunderstood fee arrangements saw the largest increase, rising to 45% over the same period. Unnecessary fees can have a substantial impact on pension income and can lead to a member running out of their pension eight years earlier than they would have done under a low-cost option.

Nicola Young, XPS Member Engagement Hub spokesperson said: “The worrying spike in recent months is driven by a significant increase in members that have little to no understanding of fees in the arrangement they want to use to access their pension savings. This may be a result of people urgently wanting to get at their savings due to current economic conditions.

“Over the last year we have seen more schemes provide access to independent and robust financial advice covering an additional 18,000 members. We welcome this, but more could be done if there were clear guidelines and regulatory protections for employers and trustees who seek to put in place education and access to such advice. We are, however, starting to see concerned trustees and employers explore and implement a signposted, safe, low cost receiving vehicle for members that do want to transfer their pension savings. This can provide comfort to schemes and members that they are not moving to a scam or overly costly arrangement.”

XPS has provided protection services for members leaving pension schemes since 2015, allowing it to track, analyse and respond to developments in scam activity. The service identifies whether any of over 40 possible red flags are present for members leaving their schemes. To date the scam protection team has been involved in 4,500 transfers representing £1 billion of pension pots. The team also provide support to trustees and administrators to investigate any red flags identified.

The firm has submitted their findings in response to a call for evidence from the Work and Pension Select Committee.

|