|

|

For years, investment-grade credit has formed a fundamental part of investment strategies for DB schemes seeking to hedge movements in insurer pricing before securing a bulk annuity. This made sense when insurers themselves were heavy buyers of corporate bonds, but that dynamic has shifted. This shift can be partly explained by the capital charges insurers face; more specifically, the combination of current market dynamics and the capital charge framework makes gilts significantly more appealing. |

By Chris Pritchard, Principal and Co-Head of Insurance Investment and Michael Hall, Investment Client Manager, Barnett Waddingham At the same time, intensifying competition in the bulk annuity market means pricing is increasingly driven by other factors – leaving credit as just one small piece of a far more complex equation. "Insurer pricing is increasingly driven by other factors – leaving credit as just one small piece of a far more complex equation." The historical role of credit ahead of buy-in

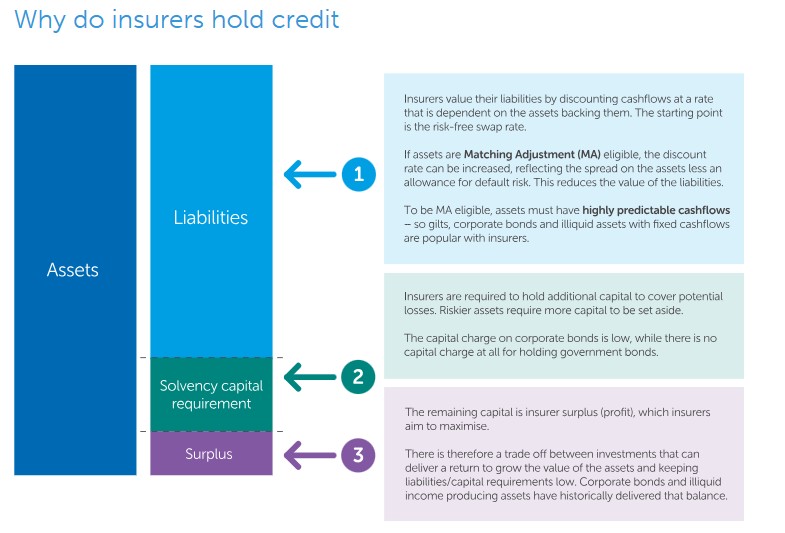

Ahead of a buy-in, DB schemes have often adopted credit exposure to mirror the allocations of insurers. In principle, investing like an insurer should help to hedge the risk of adverse movements in buy-in pricing. To understand why this relationship is beginning to weaken, it is first worth revisiting why insurers have typically held bonds within their portfolios:

In the past, investment grade credit has offered a valuable balance between predictable cashflows and a healthy return above the risk-free rate, albeit with a moderate capital charge. Crucially, even allowing for the additional capital charge over gilts, investment rated credit has historically offered a more attractive return on capital for insurers than government bonds.

Changing market conditions

More recently shifting market conditions have tilted the scales.

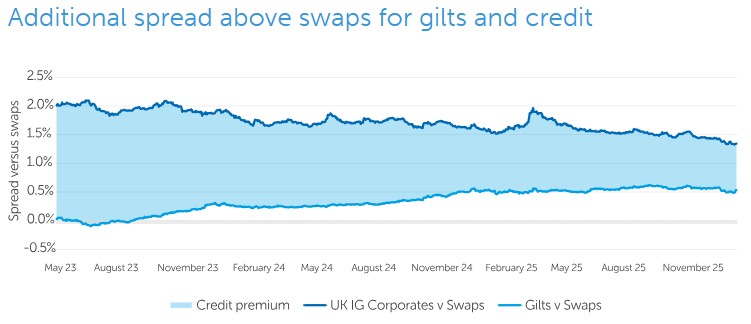

Credit spreads have tightened, with the spread on UK Corporate Bonds reaching near record lows. The compensation for taking on corporate default risk – and, for insurers, a higher capital charge relative to gilts – is far below historical levels.

The gilt-swap spread has widened. Given insurers price their liabilities against swaps, gilts now offer an attractive yield pickup without any capital charge applied under the Solvency II framework. After adjusting for capital costs, gilts have become more attractive to insurers (relative to corporate bonds), and we have seen this reflected in their investment strategies.

Source: Bank of England (UK 10 year nominal gilt yield); S&P Dow Jones Indices (Markit iBoxx GBP Corporate Bond Index); Citigroup Global Markets (10 year SONIA swap spot rate.)

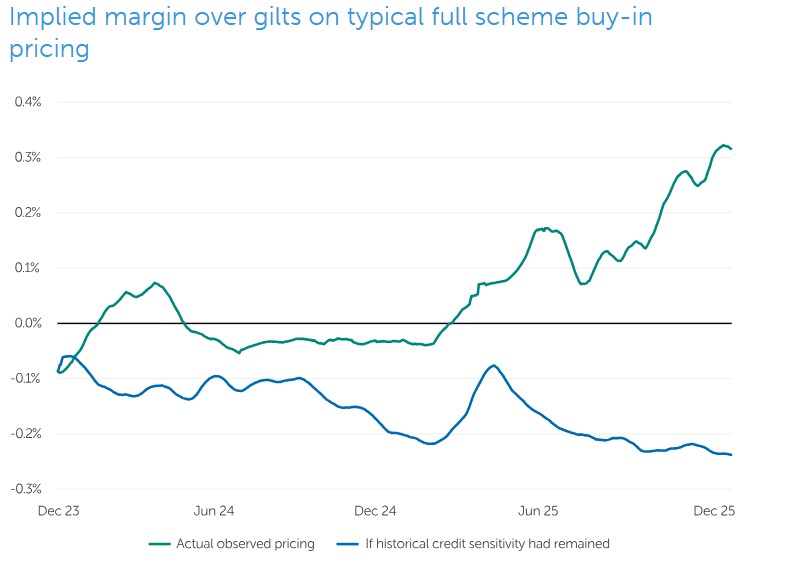

Capital efficient strategies

We set out above why gilts are currently offering insurers a more capital-efficient source of return. Some insurers are using derivatives and leverage to enhance their exposure to the gilt-swap spread. There is no capital charge for insurers from entering into these structures either, which further adds to the attractiveness for insurers in generating returns in this manner compared to purchasing credit assets. As such, the relationship between pricing and credit spreads has weakened. Since 2024, the correlation between insurer pricing and UK investment grade spreads has been negative (-0.6), having been positively correlated (+0.5) in the two years prior.

"Since 2024, the correlation between insurer pricing and UK investment grade spreads has been negative (-0.6), having been positively correlated (+0.5) in the two years prior."

There are few signs of this dynamic changing in the near future. For credit to become attractive to insurers once again, a significant widening of credit spreads, tightening of the gilt-swap spread, or some combination of the two, would be required. The emergence of leveraged gilt strategies by insurers may now be pushing this inflection point even further away.

Other factors are driving pricing

Bulk annuity pricing is not just a function of the return available on an insurer’s assets. More recently, the market has been increasingly driven by structural factors.

Improvements in defined benefit funding levels and an increasing appetite for de-risking has supported significant growth in the UK bulk annuity market, which has in turn attracted new entrants and encouraged existing market participants to expand capacity.

One way in which insurers have expanded capacity is through the use of funded reinsurance. This allows insurers to transfer liabilities to a reinsurer, at terms which are currently particularly attractive, thereby freeing up capital to take on new business.

We have therefore witnessed increasing pension scheme bargaining power, with a larger number of insurers participating in each transaction, and insurer pricing becoming more keen.

Pricing is being further supported by strategic partnerships and acquisitions, which bring with them greater investment capabilities, facilitating access to high-quality illiquid assets often at higher yields.

As a result, the narrowing of credit spreads over the past two years has not been accompanied by more expensive bulk annuity pricing.

That said, there is no guarantee that these highly competitive market conditions will be sustained over the longer term. Trustees and sponsors may therefore wish to consider whether current attractive levels of pricing support justify accelerating any plans to secure the liabilities with an insurer. Of course, this is an important strategic decision that requires a full appraisal of all relevant factors.

What does this mean for DB schemes approaching buy-in?

Credit spreads have historically exhibited mean-reverting behaviour. At current spread levels, this creates an asymmetry for investors, whereby the likelihood of a significant spread widening outweighs the likelihood of significant further tightening.

"A widening of credit spreads may erode asset values without a corresponding improvement in insurer pricing."

Meanwhile, the relationship between buy-in pricing and credit spreads is certainly much weaker than it has been historically. This does not mean there is no link at all, however, as some insurers may continue to hold shorter-dated credit, and there remains a loose relationship between spreads on longer-term illiquid assets that insurers hold and public credit markets. However, for DB schemes on the path towards buy-in, who may still hold significant allocations to credit, a widening of credit spreads may erode asset values without a corresponding improvement in insurer pricing.

Against this backdrop, our view is that DB schemes aiming to manage funding volatility versus insurer pricing should hold lower levels of credit than may have been appropriate historically. As a guide, we believe an allocation of 15-30% is a sensible starting point, but outcomes will inevitably depend on individual scheme circumstances.

"DB schemes aiming to manage funding volatility versus insurer pricing should hold lower levels of credit than may have been appropriate historically."

In particular, with buy-in pricing being increasingly driven by other factors, pragmatism is key. Decisions around credit exposure should focus more heavily on broader strategic considerations, such as return requirements, cashflow matching and overall cost efficiency, rather than an expectation of reliably capturing correlations between buy-in pricing and credit spreads going forward. For example, the case for holding credit may be stronger for schemes with a longer timeframe to buy-in (e.g. beyond 18 months), where there is a greater opportunity for the additional spread pick-up over gilts to compensate for interim spread movements. Where credit is retained, schemes may wish to favour allocations to assets with shorter maturities which are therefore less sensitive to spread volatility, such as short-dated bonds or high-quality asset backed securities.

|

|

|

|

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.