Analysis from actuarial consultancy OAC (part of the Broadstone Group) suggests that many people who were previously ill-advised to transfer out of their Defined Benefit (DB) pension are now likely to be due significantly less compensation.

Soaring annuity rates over the past 18 months mean that many transferors will now be projected to be able to secure a historically high level of guaranteed income from their remaining pension pot. This will minimise the financial disadvantage for those who are seeking compensation after being poorly advised to transfer their pension, and therefore the compensation they are due.

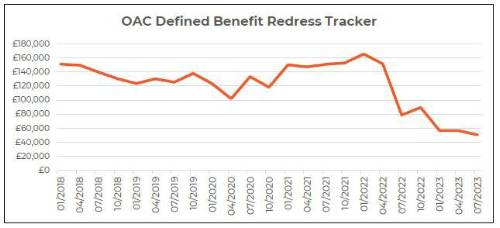

OAC’s Defined Benefit Redress Tracker follows the example of an individual who left their scheme in 2018 aged 50, with a pension of £10,000 p.a. which would receive inflation- linked increases when in payment. The Tracker is developed in line with Financial Conduct Authority (FCA) rules for calculating redress with the individual assumed to have invested their funds to earn returns in line with the FTSE Private Investor Index.

It finds that a transferor making a compensation claim in January 2022 could have been entitled to around £160,000 however that has now slipped to £50,000 as of July 2023.

Since 2018, redress has typically ranged between £100,000 and £150,000 as supressed annuity rates minimised the replacement income that transferors could have secured had they sought redress in the period to 2022.

Brian Nimmo, Head of Redress Solutions at OAC, commented: “Defined Benefit pensions offer huge security and peace of mind through retirement. The compensation process is in place to help retirees who suffered from poor advice that led to the loss of this guaranteed income throughout retirement.

“However, over the past 18 months we have seen a shift in the market whereby the rapid rise in projected annuity rates has meant people who did transfer out are now assumed to be able to secure far higher levels of guaranteed income.

“It mitigates the financial damage suffered by many DB transferors and means that they could be due significantly less compensation if they were to bring their case for compensation now.”

|