|

|

By Guy Carpenter

Previous reports in our Succeeding Under Solvency II series focused on the capital requirements associated with Pillar I, corporate governance (Pillar II) and disclosure (Pillar III). In this briefing, the third in the series, we concentrate on special considerations for reinsurance and counterparty risk.

Introduction

By any measure, Solvency II is an ambitious undertaking. Goals of the program include stronger policyholder protections, convergence of disparate accounting and regulatory regimes and a more transparent and robust (re)insurance industry.

With a phased implementation scheduled to begin in January 2013, Solvency II will impact all insurers and reinsurers either operating in or covering risks in Europe. It is built on three fundamental pillars: Pillar I addresses the quantification of capital requirements for insurers, Pillar II focuses on governance and risk management and Pillar III deals with disclosure and transparency requirements. While its final form has yet to be ratified, a great deal of preparatory effort and analysis has been undertaken and the full scope and likely effects of the directive are coming into focus.

An undertaking of this scale cannot be without controversy and pitfalls, and Solvency II certainly has its share. Like the International Financial Reporting Standards (IFRS) initiative and Basel II accord before it, Solvency II has met stiff resistance from constituents, and, as requirements have been gradually diluted and implementation pushed back to soften the impact, some external observers (including investors) have begun to criticize the program as ineffectual and expensive.

Market consensus holds that Solvency II will ultimately benefit reinsurers, as primary insurers, faced with higher risk-adjusted capital requirements, will turn to the reinsurance market as a relatively inexpensive source of additional capital and risk transfer. The consensus view further assumes that the additional revenue earned from the primary market — from mutuals and smaller carriers, in particular, who may need to add reinsurance to comply with Solvency II’s capital requirements — will more than offset reinsurers’ own additional investment costs and risk-adjusted capital constraints over the long run.

While reinsurance will continue to be an attractive source of capital and a flexible risk management tool for many insurance carriers, Guy Carpenter believes that the simplistic assumptions noted above obfuscate the numerous challenges, and a few opportunities, Solvency II presents to the market.

In this briefing, we consider the varied and sometimes subtle ways Solvency II may affect the reinsurance market and alter the way reinsurance buyers account for and manage counterparty risk.

Impact of Solvency II on the Reinsurance Market

While preparations for the new regulations are already a significant industry-wide burden, Solvency II does promise to bring some genuine improvements to the market. Noting that the results of the fifth and latest Solvency II Quantitative Impact Study (QIS 5) show that the insurance industry in Europe does not need a great deal of additional capital, and anticipating that the overall tenor of further changes to the rules will be dilutive, we perceive a number of positive developments from a cedent’s perspective.

Below we review the key benefits and drawbacks of the new regime on the reinsurance market.

Benefits

Greater transparency and convergence in reporting among Solvency II and equivalent regimes

In assessing the financial security of reinsurance counterparties, cedents often struggle to reconcile disparate accounting treatments across various domiciles. Disclosure requirements under Solvency II’s Pillar III and fair value accounting standards will bring a high level of convergence to reports and accounts in Europe and equivalent jurisdictions, greatly facilitating the analysis of reinsurer financial strength.

Some caveats: this benefit will take time to realize – up to ten years under Solvency II’s phased-in implementation as defined in the recent Omnibus II directive – and may be further diluted to the extent that internal models diverge from the standard model. Fair value accounting will also contribute to more volatile balance sheets and shorter underwriting cycles once fully implemented, as noted below.

Improved reinsurance security, overall

As the periphery of the market is gradually brought into the center by uniform capital, governance and disclosure requirements, some reinsurers will see capital requirements increase enough to facilitate a level of controlled consolidation and capital re-allocation. This ultimately will contribute positively to the overall health of the reinsurance market.

A stronger, deeper insurance-linked securities (ILS) market*

As an often more flexible and longer-term source of capital than traditional reinsurance, the insurance-linked securities market will absorb some of the net benefit that larger traditional reinsurers expect to realize through Solvency II. This will work to the benefit of cedents as the capital markets compete more directly with traditional reinsurance to limit cost pressures.

Transitional periods introduced in the Omnibus II directive should limit market disruption

(Re)insurers are allowed up to ten years to fully implement areas of Solvency II such as the fair valuation of assets and liabilities. This will allow more time to consider and implement capital and risk management strategies and will limit the impact on risk transfer and capital costs. We also expect supervisors to use the transitional period to further simplify a number of calculations and reporting requirements, including those around non-proportional reinsurance.

The Autorité de Contrôle Prudentiel (ACP), the French prudential supervisory authority, recently revealed a number of reassuring points in a conference call:

1. The European Commission confirmed that targeted transition measures are currently being considered. A “trial” year may be instituted, leading to parallel operation of existing and new Solvency II standards – with no imposition of penalties during this period.

2. Work groups have been formed, each tasked with overhauling certain points, including the rebalancing of capital requirements for certain risks (non-life and health risk underwriting and catastrophe risk, for example).

3. Possible implementation of a simplified regime or allowing the continued operation of the current Solvency I regime for very small insurers – those with less than EUR5 million in premiums and less than EUR25 million in technical reserves.

While we do expect some benefits, the challenges presented by Solvency II will likely outweigh these. We discuss three of the shortcomings and expected adverse effects on cedents and the reinsurance market below.

Drawbacks and Risks

Regulatory burden is increased

In order to fully implement and maintain Solvency II regulation, the European Economic Area (EEA) supervisors and foreign regulators seeking equivalency must dedicate much larger teams of analysts than they currently have available. Even with the expanded deadlines provided by the Omnibus II directive, it is unlikely that the supervisory authorities will have a sufficient number of trained staff without their hiring large numbers of new analysts. The costs involved with staffing-up ultimately will be passed to policyholders and cedents.

The regulatory staffing shortfall particularly will impact the many companies seeking approval for full or partial internal economic capital models. Furthermore, any resulting inefficiencies and gaps in enforcement in the early stages could damage the credibility of the overall Solvency II regime.

To estimate the size of the dedicated regulatory staff required to oversee Solvency II, we look to Standard & Poor’s (S&P), the credit rating agency. S&P has a dedicated staff of about 45 analysts in and around Europe. These include actuaries, financial analysts, economists and modelers with extensive experience in the (re)insurance industry. Between them, these analysts maintain ratings — which entail about the same level of work as monitoring a company under Solvency II — on approximately 280 companies, a fraction of the overall European (re)insurance market.

Under these economics, the EEA supervisory authorities would need to build and maintain a dedicated professional staff totaling about 600 analysts, plus over 1,000 support personnel, to regulate the approximately 3,680 (re)insurers that fall under the scope of Solvency II.1 This is a generous estimate, considering that S&P is a for-profit organization driven towards capital efficiency by shareholders.

Capital requirements and the costs of compliance are discriminately higher for smaller reinsurers and will force some consolidation

Large, diversified and highly-rated reinsurance groups with approved internal capital models will likely have materially lower capital requirements under Solvency II than they already maintain for their ratings. For these reinsurers, rating agencies will remain the final arbiters of capital requirements, while Solvency II will add administrative and regulatory cost and perversely encourage a lower standard of solvency. So far, rating agencies have resisted the demand to materially reduce capital requirements, with S&P granting only a limited weight to internal economic capital models in their assessment of risk-adjusted capitalization.2

Reinsurers of all sizes with material non-proportional books of business and/or material catastrophe exposure outside of Europe will be required to apply for internal model approval. This requirement will increase costs for those companies that do not already use internal models. QIS 5 results show that progress on internal models has been slow as companies struggle with model construction and validation.

On the other hand, many smaller or unrated reinsurers assessed under the standard model will see capital requirements increase. We may see certain niche reinsurers withdraw from the market or combine with larger companies as a result. While some consolidation will improve the health of the reinsurance market as noted above, it may also pressure rates and eliminate some of the risk transfer options available to cedents. Longer-tail lines of business will be particularly prone to rate pressure as it becomes more expensive to match long-term liabilities with long-term assets.

Solvency II may contribute to more intense and volatile underwriting cycles

A more precise (or over-calibrated) measure of solvency is naturally more prone to volatility. The widespread use of the standard model and internal capital models in conjunction with fair value accounting of assets and liabilities could contribute to shorter, more volatile underwriting cycles. It could also drive more volatile earnings and balance sheets as reinsurers, guided by economic capital models based on value-at-risk (VaR), more actively shed assets and repurchase shares in soft markets, then seek to replace capital in hard markets. While this practice may appear to be sound capital management to investors and some managers, it tends to amplify the market impact of large losses while increasing reinsurers’ cost of capital. It is also based on a spurious measure of risk.

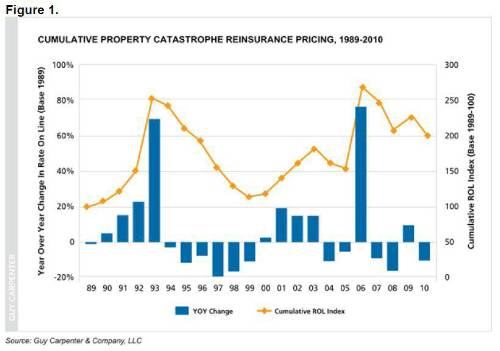

Figure 1 shows the year-on-year rate change and cumulative rate on line index for global property catastrophe business. The nearly 80 percent year-on-year average increase in pricing seen in 2006, following the shock losses of Hurricanes Katrina, Rita and Wilma in 2005, was also preceded by reinsurers returning several billion dollars in capital to shareholders in response to relatively modest price declines in 2004 and 2005. Following the events, capital flooded into the reinsurance market in response to anticipated rate increases. The establishment of new markets and “side-cars” benefited many cedents. However, several reinsurers that had been actively managing capital based on VaR and pricing trends found that they could not replace the capital that they had returned to shareholders only months earlier.

The Solvency Capital Requirement (SCR), the risk-based capital requirement for (re)insurers under Solvency II, is calibrated to a 99.5 percent VaR over a one-year period. Many internal capital models in use today also calibrate to VaR. There are a number of problems with the use of VaR as a measure of risk, many of which were illustrated over the course of the 2007-2009 credit crisis. For example, VaR is the foundation for risk-based capital requirements under Basel II, which not only failed to prevent bank failures, but arguably contributed to the crisis by providing a false sense of security around risky investments.

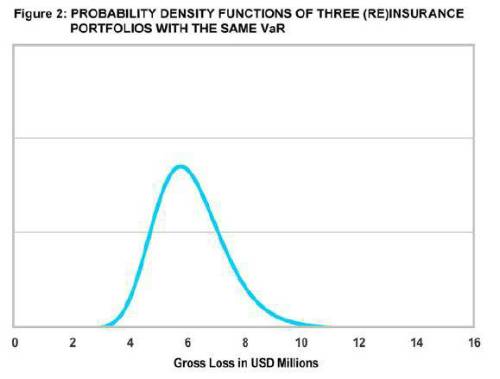

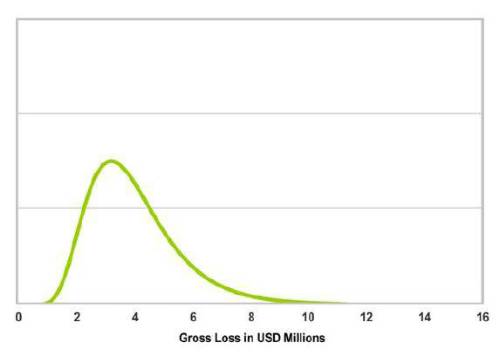

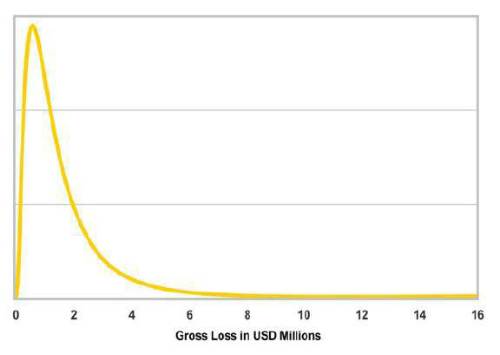

The three probability density function distributions shown in Figure 2 represent three reinsurance portfolios that all have the same VaR at 99.5 percent probability (the same level of confidence as the SCR under Solvency II). Yet the risk profile of each is clearly different. The portfolio represented by the distribution in blue has the highest average expected loss, but is actually the least risky, with its short tail, while the portfolio represented by the distribution in yellow has the lowest average expected loss, but is the riskiest because it has potential for much higher losses in its long tail.

While tail value at risk (TVaR) shares many of the same limitations as VaR and may also contribute to volatility when relied upon as the sole measure of risk, it can be a better measure of underwriting risk. In this example, the VaR at 99.5 percent probability is USD10 million for all three distributions. However, the TVaR at the same level of probability is USD10.7 million for the blue distribution, USD11.4 million for the green and USD13.4 million for the yellow.

Solvency II Counterparty Default Risk Considerations

Assessing Counterparty Default Risk

Counterparty default risk is one of the core components of the Solvency Capital Requirement (SCR). This module has undergone substantial change over the several quantitative impact studies (QIS) as the supervisors attempted to find an appropriate measure of the risk. In the QIS 5 final report, EIOPA noted that this module received the most criticism for the “overly complex approach” relative to the materiality of counterparty default risk within the overall risk-based capital requirement.3 We expect to see additional changes that will simplify the calculation of risk.

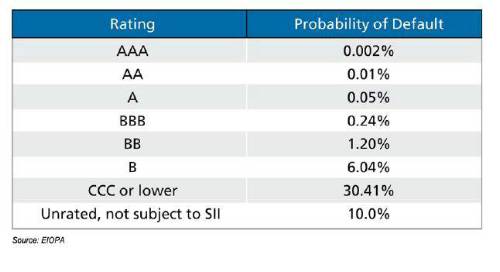

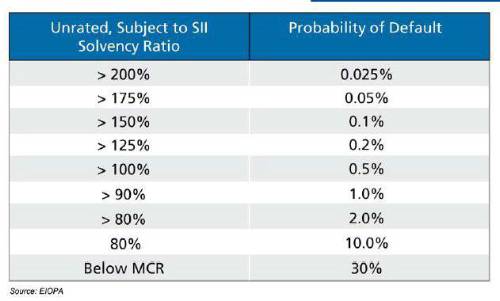

For QIS 5, counterparty risk exposures were classified as one of two types: Type 1 exposures are based around risk-mitigating contracts with counterparties that are likely to have credit ratings, including reinsurers, banks, cedents and derivative and securitization counterparties; Type 2 exposures encompass all others, including intermediaries and policyholders. Type 1 exposures are assessed based on probability of default as determined by credit ratings as follows:

Formulas for loss-given-default (LGD) vary based on the type of risk mitigating contract. For reinsurance and securitizations, LGD is defined as 50 percent of the sum of the best estimate recoverables from the reinsurance contract (or special purpose vehicle (SPV) in the case of an ILS) and any other related recoverables plus the risk mitigating effect on underwriting risk of the reinsurance in consideration, less the risk-adjusted value of any collateral in relation to the reinsurance. This is shown in the formula below. Calculating the risk mitigating effect on underwriting risk for every reinsurance contract and for every reinsurer can clearly be a daunting task for any insurer. Certain Type 1 exposures in which there are over fifteen independent counterparties are also assessed at the simplified Type 2 level. Reinsurance assets will be recorded at fair value based on best estimate of recoverables.

LGDi = (50% . (Recoverablesi + RMre,i – Collaterali),)

In addition to the complexity of the calculation, the assessment of default probability remains centered on ratings, and this is not expected to change before implementation. Solvency II thus takes the basis that insurers already use to assess financial strength (ratings) and complicates the approach. Indeed, this approach further institutionalizes the reliance on fundamentally flawed indicators. A more robust, though admittedly still complex, approach would take a page from the Basel III proposals and establish liquidity requirements based on market instruments (collateralized debt securities, bonds, etc.) for reinsurers that have them.5

Other problems with the Solvency II approach to counterparty risk identified by QIS 5 participants and other parties include difficulties in determining the risk-mitigating effects (and the counterparty risk) for reinsurance programs that include more than one counterparty; a three-month limit for past-due exposures; risk charges for cash deposited with a bank that can be higher than the charge for a bond issued by the same bank and no risk charges for investments in sovereign debt (despite the ongoing European sovereign debt crisis).6 EIOPA and supervisors will consider a wide range of simplifications for this module to address these issues prior to implementation.

Counterparty Default Risk Management

Whatever the final method for assessing counterparty default risks under Solvency II, this is an opportune time for companies to revisit credit risk management to ensure not only compliance with regulations but also to limit this non-core risk. Insurers transact with numerous counterparties, including policyholders and agents, corporate bond issuers and asset managers, reinsurers and, of course, reinsurance intermediaries.

Counterparty default risk is a by-product of dealing with each of these groups. Inevitably, some of these counterparties will default, missing or significantly delaying payments when due. Without measures in place to protect against loss, counterparty default can subject the insurance company to potentially significant financial loss. Risk management efforts should focus on limiting the impact of losses by screening through internal guidelines, diversification (with an eye on tail dependencies) and diligent monitoring. Our recommendations in each of these areas follow.

Maintain Internal Guidelines

Strong guidelines inform analysis and allow reinsurance buyers to screen out counterparties that are most likely to present the highest levels of default risk. Guidelines should allow qualitative measures as well as quantitative benchmarks, and should include metrics on claims payment and past experience. Claims payment statistics from brokers, adjusted to account for valid disputes, provide benchmarks for payments and allow the classification of reinsurance markets based on past experience within lines of business and geographic location.

Indicators of counterparty stress, which should also be considered within strict guidelines, include the level of losses/exposures versus capitalization, delays in settlements, increasing financial and operational leverage and significant declines in market measures such as share price and widening credit default swap spreads.

Internal security guidelines should be constantly assessed to determine if they are appropriate given market conditions and the nature of underlying risks.

Diversify

Diversification of reinsurance counterparties becomes more important under Solvency II as it can materially reduce the capital level required by the new regime. While it can mitigate some of the adverse impact, however, diversification cannot and is not meant to protect against major industry-wide losses, such as the financial crisis that began in 2007. Instead, diversification limits the risk related to any single counterparty.

Concentrating business with one counterparty will not likely provide sufficient rewards in terms of rates or simplicity to justify the additional risk. Broad diversification across several counterparties with largely uncorrelated results will limit the risk of a domino effect in the event of a large systemic loss event.

This risk cannot be eliminated, however, even with diversified exposure. As catastrophe and financial risk is disaggregated and spread throughout our industry, nearly every reinsurer has some exposure to major risks and perils and the counterparties on any given program will likely have correlated exposures. This can be partially mitigated by a second level of diversification across market platforms (Bermuda, Lloyd’s, Europe, Asia-Pacific, etc.).

Monitor

Cedents should establish and maintain global credit exposure monitoring platforms to be used in conjunction with their underwriting and other risk monitoring and management. Systems should enable immediate grasp of the current organization-wide risk exposure against a specific counterparty. Data management is thus critical in managing credit, insurance and investment risks as it allows the measurement of the aggregation and correlation of risks.

Data systems should also allow stress-testing by allowing parameters and counterparty credit positions to vary, and by incorporating contractual relationships (capital and credit rating-triggered provisions, etc.). Stress tests should include systemic crises such as major catastrophe losses, asset market turmoil and the evaporation of retrocession capacity.

We know that risk models based on past data can lead us to underestimate the probability of extreme outcomes, and we cannot assume that we have managed the risk simply by arriving at a quantitative representation. We also need strong qualitative skills. No counterparty should be accepted without a comprehensive review of its financials, resources and people. Equally important is cedents’ diligence in remaining informed about the counterparty’s current status and health. A team of savvy and critically minded staff should be charged with this task. This team has to rely on comprehensive, well-structured data — presupposing strong back-office management (or the assistance of a leading intermediary). This team should report directly to the chief risk officer or the board of directors, tying ceded reinsurance with premium debtor and investment credit risk monitoring.

|

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.