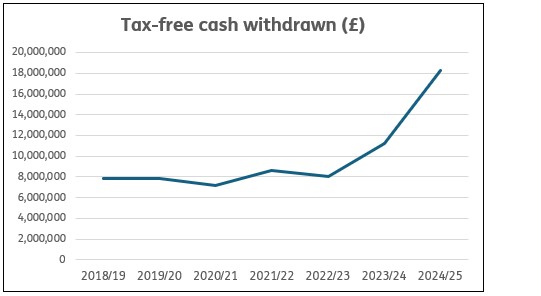

Stephen Lowe, group communications director at retirement specialist Just Group, said: “Tax-free cash is considered a hugely valuable perk by pension savers but there is clearly something driving withdrawal rates higher. In the five years up to 2022/23 annual withdrawals totalled around £8 billion but in two years they have suddenly shot up to more than £18 billion a year. On the one hand, rising living costs could be forcing more people to dip into their pension money to pay the bills. There may also be an element of concern that tax-free cash may be an easy target for governments wanting to boost the tax take to boost the country’s coffers.”

The FCA’s Retirement Income Market data revealed sales of income drawdown plans rose by 25% to nearly 350,000 in 2024/25, about 60% of them to access tax-free cash without switching on income. Annuity sales rose 8% to 88,430, the highest since the FCA started publishing the data a decade ago.

Full cash withdrawals made up 462,000 (48%) of the 962,000 pensions accessed during the year. Although the average value was £12,300, 20,000 were of pensions worth more than £50,000 and 712 were pensions worth more than £250,000.

Stephen Lowe said: “The FCA data is always pored over for clues about the financial health of those approaching and at retirement, but pot-level data is very difficult to decipher because people may well have multiple pots. Is the growth due to improving market conditions, due to worries about future pension policy, or because people are struggling with high prices? It’s probably a bit of all of three but we don’t know in what proportion. The proportion taking high – some would say unsustainable – levels of income from their drawdown pots has also increased. Now 53% of pots are paying out income rates of more than 8% of their value, compared to 48% paying out that level of income last year. Perhaps most worrying is that use of professional help such as regulated advice or even the free, independent and impartial Pension Wise service is continuing to slip. Accessing pensions is a major life decision and it is concerning so many are doing it with no formal support.”

FCA Retirement Income Market Data, 2024/25

|