By Daniel Sacks, Analyst, Insurance Consulting, LCP

Emerging risk is not a new topic, so why am I talking about it now? Emerging risks are developing, and how actuarial teams consider them can vary, so a framework can help navigate emerging risks in a consistent way.[IW5] [DS6] Our article looks at a framework for managing emerging risks, with an example of how we can apply it to wildfires in the UK.

A framework for managing emerging risks

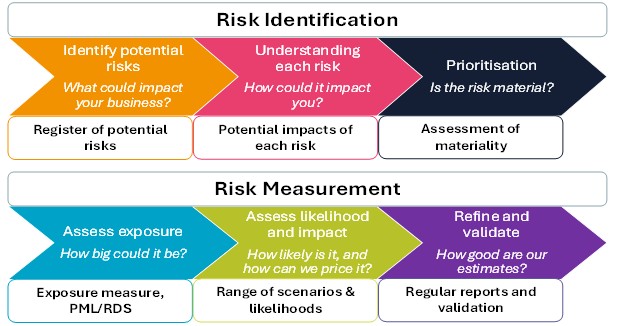

Our framework for emerging risk begins with risk identification and then moves to risk measurement.

You can use a range of methods for identifying the potential risks – workshops, interviews, questionnaires, networking and watching market trends are all useful tools. It’s important to understand the drivers of the risk and the areas of the business they may impact. It can then be helpful to try and prioritise emerging risks based on some form of risk ranking (either quantitative or qualitative).

Emerging risk measurement can be challenging - how do you quantify the unknowns? The framework helps us to build an estimate of the impact.

Exposure: Consider factors such as policy limits, probable maximum losses, and realistic disaster scenarios. These provide a structured way to gauge the scale of potential exposure and highlight where concentrations of risk may exist.

Likelihood and Impact: Assessing these requires looking at practical examples for each identified risk to understand how claims might manifest. Severity estimates can often be derived from existing data, such as sums insured, while frequency estimates may need to draw on external sources or expert judgment to fill gaps where historical data is limited.

Exploring an emerging risk: UK wildfire

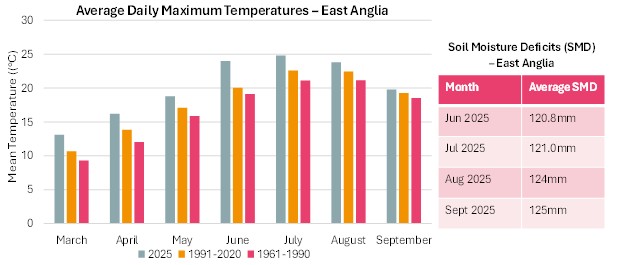

Wildfire risks in the UK are increasing, both in terms of the number of fires and the areas burned. Take Thetford Forest in East Anglia as an example. Over the summer, there were four large wildfires, burning over 30 acres of forest, which is much more than in previous years. The question we need to ask is, what’s changed? Over the summer, East Anglia, like much of the UK, had a very dry and warm period, with a significant soil moisture deficit and average daily maximum temperatures exceeding averages. These two factors turn the forest into a tinderbox, with just one careless BBQ or cigarette needed to set it ablaze.

When trying to model this risk, and particularly given that the risk appears to be changing, it is worth thinking about the following two features:

1. Data drift

Data drift refers to a situation where the overall level of risk changes uniformly across the portfolio, without altering the relative risk between segments. For example, if fire risk increases evenly across all regions in the UK, the relationships between risk drivers remain stable. In such cases, adjusting the model for data drift is relatively straightforward because the structure of the risk remains consistent.

2. Concept drift

Concept drift occurs when the relationship between risk drivers evolves, meaning the underlying assumptions of the model no longer hold. This is often seen in complex, dynamic risks such as those driven by climate change. For instance, if significant housing development takes place along the rural-urban frontier, it could increase fire risk disproportionately in certain regions. This shift requires re-examining regional risk drivers because the correlation between location and risk has changed. Concept drift is harder to quantify, particularly for long-tailed lines, where delayed claims development makes it challenging to detect these changes through purely quantitative measures.

Whilst we can look at other forest fires in the UK to help us understand the severity, we don’t have enough data to reliably estimate the severity. We often think there is little we can do to increase the dataset we look at in the UK to understand the relationship between inputs and outputs of forest fires. However, the UK is not experiencing climate change alone, and we can see from data that East Anglia is now climatologically similar to La Rochelle, a small coastal town halfway down the Atlantic coast of France, between 1991 and 2020. We can use historical data from La Rochelle, and other similar areas round the Bay of Biscay, to help us increase the dataset we look at when estimating the frequency of forest fires based on weather inputs, such as rainfall and temperatures.

Conclusion

-

A framework for identifying and measuring emerging risks is an important feature of insurance modelling.

-

Different actuarial teams need to work together to ensure that emerging risks are addressed consistently across pricing, reserving and capital modelling.

-

Wildfire is a real risk in the UK, and insurers with significant exposure need to develop a strategy for dealing with it. The strategy needs to include modelling as basic quantitative measures alone are not justified given the risk.

|