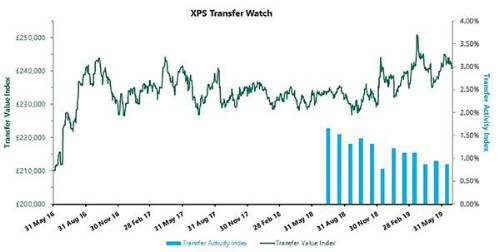

XPS Pensions Group’s Transfer Value Index stayed much steadier over June but ended the month at £240,800; down from £241,500 at the end of May. The fall was driven by a slight reduction in expectations for future inflation.

XPS Pensions Group’s Transfer Activity Index has shown a slight decrease in the number of transfers that the administration business processed during June, compared to May. The transfers processed would imply an annual equivalent of 0.87% of eligible members, compared to 0.94% last month. This remains below the average that we have seen over the last 12 months, of 1.18%.

In market news, the Financial Conduct Authority (“FCA”) have published the results of their analysis of firms carrying out pensions transfer advice between April 2015 and September 2018. This covered 234,951 instances of advice across 2,426 firms, revealing that 69% of members were recommended to transfer out of their pension schemes.

Mark Barlow, Senior Consultant, XPS Pensions Group commented: “June has seen a welcome stabilisation of the transfer market. Transfer values remain relatively flat and activity continues to run at an annual rate just below 1%.

“The results of the FCA study into DB transfer advice are concerning. In particular, the recommendation rates are significantly higher than that seen by our clients who have appointed a financial adviser to support their members. There is a risk that members are making decisions that are not in their best interests and we welcome the steps that the FCA is taking to improve the standards of pension transfer advice.”

ENDS

|