Aegon has lobbied for the FCA to formalise a triage approach saying it would be beneficial for both advisers and customers to be able to ‘cut short’ the process, saving time and money and allowing the limited supply of advice to focus on customers more likely to benefit from transferring.

Aegon has also come out in support of FCA exploring how it can allow contingent charges to continue.

Steven Cameron, Pensions Director at Aegon said: “In medical terms, ‘triage’ involves a professional assessing an individual’s circumstances and determining next steps and their priority. But the triage being proposed for DB transfers excludes any professional assessment and is closer to self-diagnosis through google.

“We are calling for the FCA to explore what more advisers can offer within guidance to help customers reach an early decision. It’s positive that the FCA has set out a non-exhaustive list of considerations for advisers and we’d like to explore if this could be turned into a standardised traffic lights guide for consumers wondering if it’s worth their while seeking advice. This could be promoted by advisers, quidance bodies and trustees.”

Aegon has set out a ‘straw man’ guide to illustrate the concept and is keen for wider debate on how this might be developed.

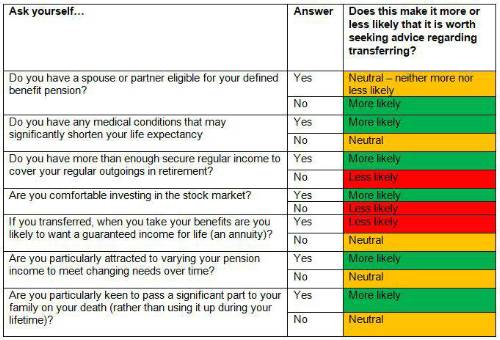

Aegon’s ‘straw man’ guide – for illustration only

The following table sets out some of questions which may help you decide whether or not you wish to seek advice on transferring from a defined benefit or final salary scheme.

If your answers include a number of greens, then as a rule of thumb, it may be worth exploring further although this DOES NOT suggest you should actually transfer.

If you have one or more red answer, then the rule of thumb is it may be less worth exploring transferring although again this DOES NOT mean you definitely should not transfer.

If you seek advice, your adviser will consider all of your personal circumstances and make a personal recommendation based on these.

|