By Charl Cronje, Partner, LCP

The ideas here are particularly relevant for actuaries working in general insurance who are involved in portfolio management, business planning or pricing – and who want to play a more active role in shaping and executing underwriting strategy.

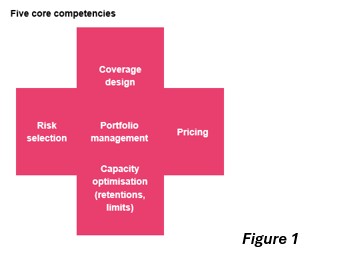

Five core underwriting competencies

The London Market trades on underwriting expertise – exactly why the largest and most complex risks come to London. To compete, firms need to be clear on their relative strengths and weaknesses across the five core underwriting competencies (see figure 1):

Competitive strengths and weaknesses in each area will differ by class of business and may change over time. For a given portfolio, we need to ask ourselves whether our competitive edge lies in:

• Better product design

• Superior risk selection

• More accurate pricing models

• Participating in the highest margin layers and with the right line sizes

• Being more agile in flexing our portfolio when market conditions shift

The best firms have keen self-awareness of their abilities in each area, and clear plans to improve where possible.

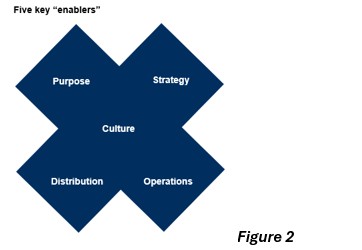

Five strategic enablers and blockers

We’ve identified five key enablers to executing your strategy effectively (see figure 2). Where these pieces are not in place, they can become strategic blockers, frustrating efforts to grow profitably.

Strategy: this is all about how clearly the strategy is articulated by the board and how well it is understood by underwriting teams. It often boils down to three questions: where are we trying to grow, how quickly and within what risk appetites?

Culture: this covers the underwriting environment, how individual and team contributions are recognised, and how the organisation responds when things go wrong. A culture that doesn’t promote trust between underwriters and management makes it much harder to shift strategy or take calculated risks.

Distribution: even the sharpest underwriting strategy needs strong broker relationships to deliver the right opportunities. We covered this in some detail in last month’s article. The best firms bring this together with a keen understanding of which broker relationships are delivering the best value over time.

Operations: smooth operational processes are critical to executing strategy effectively. Operational friction raises costs, slows decision-making and leads to missed opportunities.

Purpose: clarity on what the firm stands for and where it plays. This could be as specific as being a catastrophe specialist, casualty expert, or diversified player with the agility to “fish in the right ponds at the right times”. Purpose also extends to ESG and DEI positions, which can influence internal engagement and external appeal.

Performance attribution

Assuming we are clear on our underwriting competencies and have the right strategic enablers in place, we then come to the nitty-gritty of assessing the profitability of underwriting portfolios and deciding where to set our course for the future. Most firms measure underwriting performance, but performance attribution goes further and identifies the root causes of good or poor performance. An excellent framework for assessing this involves the following four attribution “buckets” (see figure 3):

Market performance: this is the extent to which results simply reflect market conditions. For example, a strong loss ratio in a hard market might be largely a function of improved rates across the board. This is important to recognise – good results in a rising tide do not necessarily signal outperformance.

Strategic outperformance: this is the gold standard – outperforming our peers, regardless of the market cycle. This is where true underwriting skill shows. Link it back to the five competencies to identify exactly where the edge lies and whether it can be scaled.

Volatility: Any underwriting performance will be subject to volatility, aka luck! We may have a low loss ratio simply because we were fortunate enough to avoid any large claims this year. Good firms build in volatility allowances into performance assessment. Eg you might have a much tighter volatility allowance for large, diversified follow-only portfolios and a wider allowance for concentrated, cat-exposed books.

Execution risk: the gap between the intended and actual book written. Poor performance can stem from being priced out of the best risks and left with less attractive ones; good performance can sometimes be the result of unplanned but fortuitous deviations. Top firms try to minimise strategy execution mismatches. They also have frameworks for agreeing tactical changes during the year if market conditions demand this.

Bringing it all together

The building blocks of underwriting competencies, strategic enablers and performance attribution are essential to a coherent underwriting strategy. But the real value comes from how you bring them together to appraise every strategic underwriting opportunity on a level playing field.

The most advanced firms can compare business plans from entirely different classes of business on a like-for-like basis. This is possible because they understand how each portfolio’s historical performance breaks down across the attribution buckets. Armed with this insight, they can judge whether poor results stem from weaknesses in the underwriting process itself or from external factors such as market conditions or volatility. Similarly, when performance has been strong, they can assess how much is due to sustainable strategic outperformance versus a temporary lift from favourable market cycles or benign loss experience.

When underwriters propose plans to grow a book or to address underperformance, the best firms require these to be framed against the five competencies. Is the improvement expected to come from sharper risk selection (supported by strong broker relationships), from refining layers and line sizes, or from product innovation that reduces commoditisation of pricing?

All of these factors enable management to develop and quantify their “strength of conviction” that good results can be maintained, or poor results remediated, for each class of business. Done well, this shifts the conversation from anecdote and gut feel to evidence-based decision-making – without losing the instinct and judgement that are central to great underwriting.

|