This update gives further detail on the proposed court action, including identifying the representative sample of policy wordings to be examined in the test case, insurers that use those wordings, and which of those insurers we have invited, and have agreed, to participate in the proceedings.

This initial list of insurers and the policy wordings they use is not exhaustive, and they are also now publishing a short consultation on draft guidance asking all insurers to check their policy wordings against those they intend to test to see if theirs will be impacted by the outcome of the case. The FCA expects to publish a list of all the relevant insurers and policies that may have impacted wordings in early July.

The consultation on draft guidance also sets out the FCA’s expectations of all firms handling BI claims and any related complaints between now and the court decision.

Christopher Woolard, Interim Chief Executive at the FCA said: ‘The court action we are taking is aimed at providing clarity and certainty for everyone involved in these BI disputes, policyholder and insurer alike. We feel it is also the quickest route to this clarity and by covering multiple policies and insurers, it will also be of most use across the market. The identification of a representative sample of policies and the agreement of insurers who underwrite them to participate in these proceedings is a major step forward in progressing the matter to court.’

The outcome we are seeking

They want to achieve clarity for all concerned in an unprecedented situation. To do this, they are taking a representative sample of cases to court. The FCA will put forward policyholders’ arguments to their best advantage in the public interest. The FCA has retained the services of Colin Edelman QC, Leigh-Ann Mulcahy QC, Richard Coleman QC and Herbert Smith Freehills to assist it in the case.

As stated in their Dear CEO letter of 15 April, their view remains that most SME insurance policies are focused on property damage (and only have basic cover for BI as a consequence of property damage) so, at least in the majority of cases, insurers are not obliged to pay out in relation to the coronavirus pandemic. This case is focused on the remainder of policies that could be argued to include cover.

Policyholders should not assume that simple inclusion of their policy wording in this case will mean their policies are responsive. We are seeking a judgment that will help policyholders and insurers have a much clearer view of which business interruption policies respond to the pandemic, and those that don’t. Therefore, the court may well decide a number of these policies respond to the pandemic and others do not.

How we have chosen the representative sample of policy wordings

On 1 May 2020, their statement set out their intention to seek a court declaration to resolve the contractual uncertainty around the validity of many BI claims.

Also on 1 May 2020, they asked 56 relevant insurance companies to provide them with information on their BI policies with more than 500 policyholders, and how they intended to handle claims on these policies by 15 May 2020. A number of the relevant insurers decided to accept claims from policyholders with certain policies which included particular wordings which had previously been in dispute.

On 15 May 2020, they also invited holders of BI insurance policies who remained in dispute with their insurers over the terms of their policies to send them their arguments, related policies and relevant facts by 20 May 2020. They received over 1,200 submissions from policyholders and brokers.

Over the last 3 weeks they, supported by external counsel, have thoroughly considered the information they received to enable them to decide which selection of policy wordings would be representative of the key issues in dispute between policyholders and insurers. This process led to to deciding which insurers they should invite to participate in the High Court test case.

The representative sample of policy wordings

From all the policies they reviewed, they have selected a representative sample of 17 policy wordings to give as much clarity as possible to both insurers and policyholders alike. Rather than select firms by market share, they have identified policies which are representative of the key arguable issues and invited insurers to participate on the basis of securing the maximum relevant coverage for relevant policies whilst minimising the number of parties engaged before the court in order to make the process as swift as possible for the court.

The insurers who use the representative sample of policy wordings

The following 16 insurers use at least one of the policy wordings in their representative sample which will be examined in the test case:

Allianz Insurance plc (part of Allianz SE)

American International Group UK Limited (part of American International Group, Inc.)

Arch Insurance (UK) Limited (part of Arch Capital Group Limited)

Argenta Syndicate Management Limited (part of Hannover Re)

Aspen Insurance UK Limited (part of Aspen Insurance Holdings Limited)

Aviva Insurance Limited (part of Aviva plc)

Axa Insurance UK plc (part of AXA SA)

Chubb European Group SE (part of Chubb Limited)

Ecclesiastical Insurance Office plc

Hiscox Insurance Company Limited (part of Hiscox Limited)

Liberty Mutual Insurance Europe SE (part of Liberty Mutual Group)

MS Amlin Underwriting Limited (part of MS&AD Insurance Group Holdings, Inc.)

Protector Insurance UK (part of Protector Forsikring ASA)

QBE UK Ltd (part of QBE Insurance Group Limited)

Royal & Sun Alliance Insurance plc (part of RSA Insurance Group plc)

Zurich Insurance plc (part of Zurich Insurance Group Limited)

The wordings that they use are set out in this list.

Following the process described above, they have asked the following insurers, who underwrite policies in the representative sample, to assist them by participating in the High Court test case:

Arch Insurance (UK) Limited

Argenta Syndicate Management Limited

Ecclesiastical Insurance Office plc

Hiscox Insurance Company Limited

MS Amlin Underwriting Limited

QBE UK Ltd

Royal & Sun Alliance Insurance plc

Zurich Insurance plc

These insurers have entered into a framework agreement with them governing the process and timetable for the test case.

How this will affect insurers who are not participating directly in the test case

Given the representative nature of the policies and wordings they have selected, they expect the test case to provide guidance for the interpretation of many other BI policies that are not in the representative sample.

This means that other insurers will also be affected by the test case and its conclusions. In early July, they expect to publish a comprehensive list of other insurers and many other BI policies in the market that they expect the test case to affect, based on firm submissions.

Other documents we have published today

In addition to the FCA’s proposed representative sample of terms, they have also published proposed assumed facts (for example, the types of business and how they responded to the pandemic), a proposed issues matrix and proposed questions for determination by the court. They invite comments from other insurers, policyholders and other stakeholders on these documents by 3pm on Friday 5 June.

They have also issued a consultation on draft guidance to set out their expectations of all firms handling BI claims and any related complaints during this period, including an expectation that they identify those policies where their decision to deny claims may be affected by the test case.

For all interested parties their legal team at Herbert Smith Freehills will be available on 3 and 4 June to speak directly with as many policyholders and intermediaries as possible. Further information is on their business interruption webpage.

Next steps

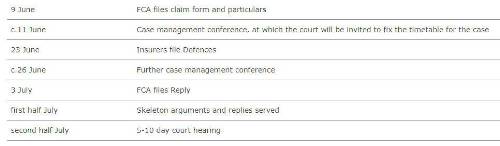

They give the principal next steps and timelines for how they envisage the test case to proceed below. There remain a number of uncertainties to the timeline including the consent of the court:

|