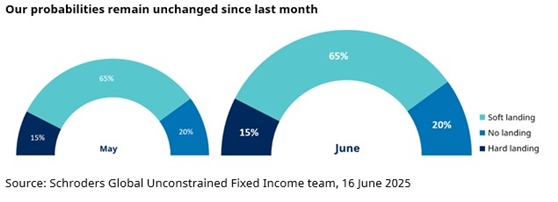

Yes, as always, there has been significant newsflow in the interim (we will continue to observe events in the Middle East closely), but as we sift through the economic data we have received in the past month, we see little need to change the probabilities we assign to our scenarios. We continue to see a soft landing as the likeliest outcome (65%), with a slight skew in favour of no landing (20%) - where the US Federal Reserve (Fed) is unwilling or unable to cut at all in 2025 - versus the risk of a hard landing.

For illustrative purposes only. "Soft landing" refers to a scenario where economic growth slows and inflation pressures ease, allowing modest further rate cuts; “hard landing” refers to a sharp fall in economic activity and deeper rate cuts are deemed necessary; “no landing” refers to a scenario in which inflation remains sticky and interest rates may be required to be kept higher for longer.

Muddling through

How have we got to this conclusion? Let’s start with the US economy – still the bedrock of global financial markets.

Broadly, the economy has performed in line with our expectations – official (‘hard‘) data from April and May has softened, but hasn’t been disastrous, while sentiment (survey or soft) data has improved. The labour market remains stable, while inflation data is yet to truly reflect the impact of price rises from tariffs, and so far has been well contained.

Where to from here? Well, though the uncertainty created by government policy is dampening US growth, we remain comfortable with the view that it will continue to expand at a decent—if unspectacular—pace: not too hot; not too cold.

In no small part this is due to the unlikelihood of a sharp slowdown in consumer spending given strong real income growth (that’s income adjusted for inflation). This has primarily been driven by increased government fiscal support. While this is bad for long-term debt sustainability, in the short-term it’s a supportive factor for consumption and therefore growth.

What could change this? As ever, a meaningful weakening of the labour market would be the key factor for becoming more concerned about the growth outlook. We’ll continue to monitor a raft of labour market data closely – paying particular scrutiny to jobless claims, which have been rising recently.

The end of the line

Over in the eurozone, the main development in the last month has been the recognition from the European Central Bank (ECB) that we are nearing, if not at, the end of their interest rate cutting cycle. We feel that the justification for further interest rate cuts is limited, in light of improving growth across the region and increasingly supportive fiscal policy (particularly government spending).

Meanwhile, in the UK we are seeing clearer signs of a slowdown in the labour market as well as a cooling of underlying inflation pressures, such as wage growth. We think the market’s expectations of a comparatively higher terminal rate - the interest rate at the end of the current cycle - in the UK offers opportunities, as we anticipate some convergence with other major central banks.

Where are the opportunities?

In rates, we continue to have a neutral stance towards overall duration (interest rate risk) and instead favour curve steepening trades in the US (expressed through a long position in the 5-year point of the curve with a corresponding short position in the 30-year) as well as cross-market opportunities (for example, long gilts against Canada and Germany).

In corporate credit, following strong positive performance, we downgrade our score for US CDX high yield (credit default swap indices) as the valuation argument diminished.

We maintain a negative score on overall investment grade (IG) given expensive valuations, but remain relatively more positive on shorter dated securities within this sector.

US agency mortgage-backed securities (MBS) remain our top pick in asset allocation as they continue to offer comparatively higher yields and lower volatility versus US IG corporates.

|