By Esther Ajayi, Associate Consultant, ORS – FINEX GB and Richard Langdon, Asset Management Industry Lead, FINEX GB Financial Institutions, WTW

The 23% rise in single and multiple Employment Tribunal claims in 2024/25 reflects a clear increase in EPL exposure, yet despite this, coverage remains significantly underutilised across the UK financial services sector.

The risk landscape is shifting

Picture this: a financial institution hit with a multimillion-pound lawsuit over employee discrimination. The reputational fallout alone could be devastating, and the financial impact even more so. This scenario became a reality in 2023, when a major bank was ordered to pay £171 million in a gender discrimination case - a clear sign that such claims are part of a growing trend that employers cannot afford to ignore.

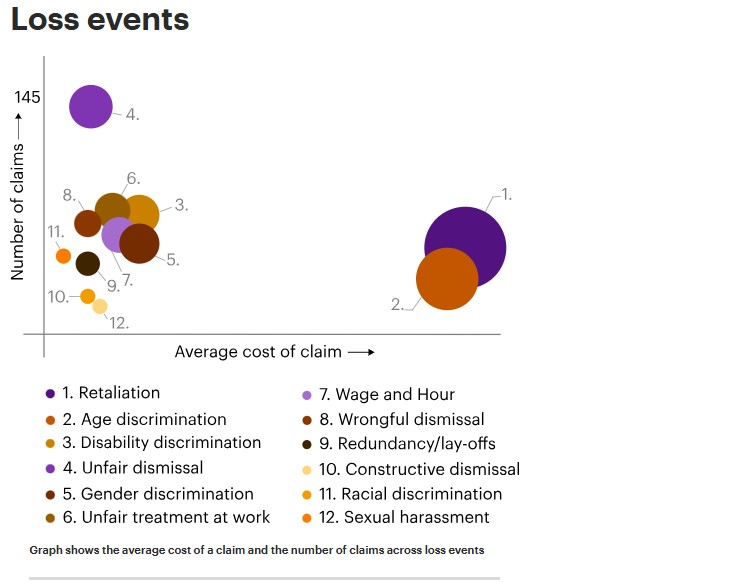

Our data from non-US markets reveals that EPL claims are both frequent and financially significant, averaging £147,000, with some settlements exceeding £5.5 million. Retaliation claims stand out as the costliest, with age discrimination close behind, and unfair dismissal among the most frequently reported.

EPL insurance remains widely overlooked in the UK financial sector.

Yet despite this clear and present danger, EPL insurance remains widely overlooked in the UK financial sector. Our data estimates that only 2% of UK financial institutions currently purchase EPL cover, with a median limit purchased of £3.4 million. This represents a modest investment for significant protection, and a stark contrast to the potential cost of inaction.

The bottom line? EPL risk is rising, as shown by a surge in recent UK notifications. If the coverage is readily available, why aren’t more firms choosing to protect themselves?

For many, it comes down to perception. EPL risk is often underestimated and seen as a ‘soft’ exposure or something that only affects larger, high-profile companies. Others assume their existing liability policies will bridge the gap, only to discover too late that employment-related claims are typically excluded. And in some instances, it’s simply a case of inertia, or a belief that “it won’t happen to us.”

But this mindset is becoming increasingly risky.

Employment reform: What it means for employers

The introduction of the Employment Rights Bill 2024-25 marks a fundamental shift in the UK employment landscape. Described as “the biggest upgrade in employment rights for a generation,” the bill introduces:

- Qualifying period for unfair dismissal reduced from two years to six months

- Expanded statutory sick pay and bereavement leave

- Protections against harassment

- Restrictions on fire-and-rehire practices

- Flexible working rights

- A new Fair Work Agency to oversee compliance

While these reforms aim to enhance job security and fairness, they also increase the legal and operational burden on employers. For financial institutions, the implications are clear: more regulation, more complexity, and more potential for disputes.

The regulatory spotlight is also intensifying on workplace culture. In our 2025 Directors & Officers (D&O) Survey, 63% of respondents identified Diversity, Equity and Inclusion (DEI) as a top priority, while 56% flagged human rights breaches as a key risk. Regulators increasingly view DEI as a proxy for governance quality, as well as and a potential source of liability.

So, the question becomes: Are you making an active decision to self-insure against these risks? Or is it time to reassess your exposure and secure adequate protection?

A smarter way to protect your people and your business

Many standard commercial liability policies exclude employment-related claims, leaving a critical gap in protection. EPL insurance is designed to close that gap – and it does so effectively. On average, 95% of total EPL losses fall within policy coverage, with most claims comprising settlement and defence costs.

It’s important to distinguish between individual and entity EPL cover. Individual protection is typically included under Directors & Officers (D&O) insurance, but this does not extend to the entity itself. Increasingly, claimants name both individuals and the corporate entity in employment-related suits to maximise their chances of a successful settlement. Without dedicated entity EPL, the organisation may be left exposed.

|