|

|

Woodford Patient Capital Trust has raised £800million, placing it comfortably at the top of the list of biggest UK investment company launches. |

Ian Sayers, Chief Executive, Association of Investment Companies (AIC), said:

“It’s encouraging to see that Woodford Patient Capital is by far the largest UK investment company launch. It’s a testament to the investment company sector that this distinctive company is taking advantage of the benefits of the closed-ended structure, such as the ability to invest in specialist, small, less liquid assets.”

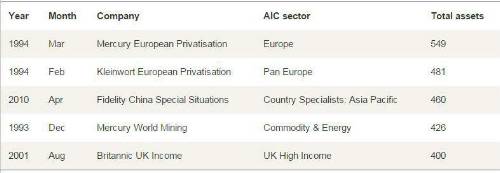

Largest UK investment company launches

Before the launch of Woodford Patient Capital Trust, the biggest UK investment company new issue was Mercury European Privatisation, which launched in March 1994 having raised £549million. This broke the record set just one month earlier by Kleinwort European Privatisation, which raised £481million. More recently in April 2010, Fidelity China Special Situations was the third largest UK investment company raising £460m.

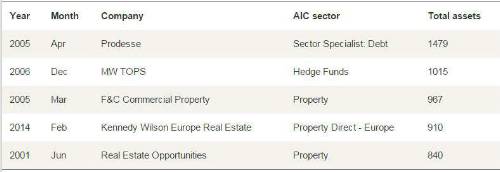

Largest non-UK investment company launches

The largest non-UK investment company was Prodesse, which launched having raised £1,479million in April 2005. MW Tops is the second largest non-UK launch, raising £1,015million in December 2006. F&C Commercial Property is the third largest non-UK launch raising £967m in March 2005.

|

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.