As the UK heads into the Autumn Budget, the current freeze on income tax thresholds could be extended – meaning millions could pay more tax without any change to rates as rising wages push them into higher tax brackets. Against this backdrop, new analysis from Standard Life, part of Phoenix Group, highlights how directing extra pay such as overtime into a pension could reduce the tax impact of moving into a higher tax band and deliver a potential six-figure boost to long-term savings.

Many of us know the reality of putting in extra hours - whether it’s to cover rising bills, meet a deadline, or keep everything running smoothly. In fact, a recent survey found that the average UK employee clocks up an additional 215 hours a year1. While not everyone receives overtime pay, those who do could see a boost to their pay packet - with these extra hours reported to be worth an average of £4,022 in additional income. However, for those who are earning more overtime than they need to cover everyday costs, this extra pay could do more than just top up today’s salary.

Overtime today, extra income tomorrow – and a potential buffer against frozen tax thresholds

Auto-enrolment ensures most employees contribute to a workplace pension, but contributions are typically based on salary alone, meaning extra earnings such as bonuses and overtime aren’t typically included. Therefore, for those receiving regular overtime payments, especially in sectors such as manufacturing and construction where overtime is often 1.5 times the normal rate, it’s worth considering whether any of this additional income can be used to boost your pension pot.

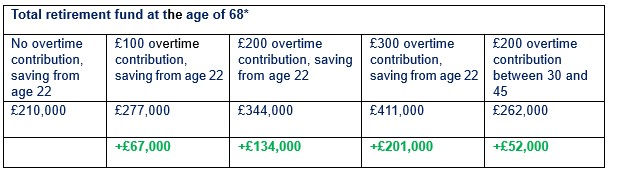

Standard Life analysis shows that someone who began working full-time with a salary of £25,000 a year and paid the minimum monthly auto-enrolment contributions from the age of 22 could have a total retirement fund of £210,000 by the age of 68, allowing for 2% inflation over the period1. However, someone who chose to contribute just £200 of overtime pay a month for the duration of their career, on top of minimum contributions, could build up as much as £344,000 in their pension by the age of 68 – £134,000 more. Increasing this to £300 of overtime pay a month could result in a pot of £411,000 in today’s prices.

With frozen tax thresholds pulling more people into higher tax bands, redirecting overtime earnings into a pension could help reduce tax liability. Pension contributions receive tax relief, meaning that money paid into a pension may avoid being taxed at a higher rate if overtime earnings would otherwise push someone into a higher band.

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures allow for 2% inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied. The value of investments can go down as well as up and may be worth less than originally invested.

Even smaller contributions can still make a significant difference. Someone contributing an additional £100 of overtime pay a month could retire with £277,000 - £67,000 more than if they had only paid the minimum. Additionally, those who work overtime for a limited period could also see a significant benefit if earnings were directed into their pension pot. For example, contributing an extra £200 a month between ages 30 and 45 could boost a pension by £52,000, giving a total pot of £262,000 adjusted for inflation.

Gail Izat, Managing Director for Workplace Pensions at Standard Life said: “With income tax thresholds potentially being frozen for longer at the Autumn Budget, rising earnings could push many more people into higher tax bands. Redirecting additional pay like overtime into your pension is a smart way to reduce that impact while boosting your long-term savings. Auto-enrolment gives people a valuable start in saving for retirement, but many will need to contribute more than the minimum level to secure a comfortable retirement. Adding extra contributions from overtime or other additional income can be a practical, budget-friendly way to strengthen your financial future - and because pensions are tax-efficient, these contributions can help you keep more of your income. If you’re unsure of your personal situation, it’s worth speaking to your employer or pension provider for guidance.”

|