The Aegon Financial Priorities Survey 2024 reveals that feeling old in their 60s came out top with 20%, closely followed by people feeling old in their 50s (19%). Some were still feeling youthful into their 70s (14%), but for others, life wasn’t just beginning in their 40s (12%). Meanwhile, an ever-youthful one-in-ten (9%) say they don’t think they will ever feel old, and 12% said that they did not know.

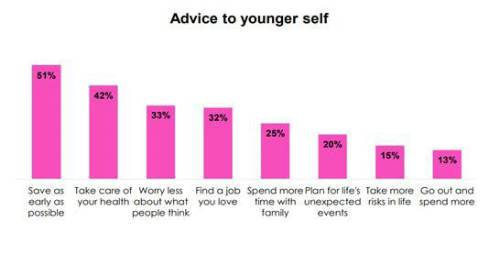

The survey also shows that if we could travel back in time and offer advice to our younger self, given a range of options, over half (51%) would plump for ‘start saving as early as possible’.

Other popular advice to our younger selves includes taking care of our health (42%) and to worry less about what others think (33%).

Commenting Steven Cameron, Director of Pensions at Aegon, said:“While every individual is unique, many of us now live longer lives and our expectations and hopes for every stage of life, including those later years, are changing.

“Not so long ago, people tried to comfort themselves that rather than being past your best, ‘life begins at 40’. Then there was a period when you’d hear ‘50 is the new 40’ – so perhaps another way of looking at this research is that 60 is now the new 40.

“These new findings showing that over half of us wish we could have started saving earlier highlights just how important putting some money aside for the long term really is.

“Just a small increase in contributions can have a massive positive impact on the opportunities we open up for our future years.

“Regardless of how old or young you feel, it’s vital that we individually and collectively give thought towards how we plan for and navigate this phase of life. Aegon’s benchmark Second 50 report is a great starting point to guide that ongoing discussion.”

Jonathan Bland, Head Geek at Pension Geeks, said: "In our experience of going into workplaces and doing hundreds of live TV shows, we’ve never ever met someone who has any regret of saving too much into their pension at the time of retiring or getting near to it. So, I think it’s a great thing that the younger audience are getting informed and educated about the importance of saving for your future. I’d say it’s never too early, or late, to start saving."

|