It reports balance as at 31 March 2023 of £72.5 billion, £4.8 billion higher than that estimated in the report last year (£67.6 billion) thanks to higher than expected earnings and employment levels.

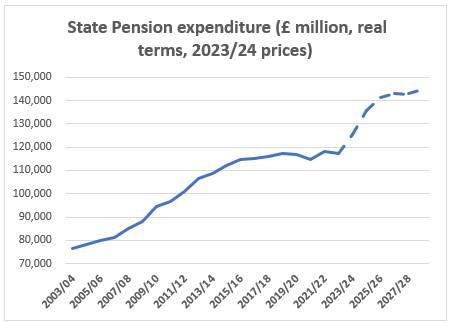

The uprating of benefits is expected to increase total benefit expenditure by £10.8 billion with payments from the National Insurance Fund expected to exceed receipts by £3.2 billion in 2024-25.

From then on, the balance of the Fund is projected to decrease as benefit expenditure is projected to exceed contribution income in every year of the projection period (up to 2028-29) albeit further Treasury grants are not expected to be needed.

Most significantly, a projected increase in the number of state pension recipients, relative to the working age population, would increase Fund expenditure relative to income. In the absence of additional financing the Fund could be exhausted in the next 20 years according to GAD.

Damon Hopkins, Head of DC and Workplace Savings at Broadstone said, “The Up-rating report on the government’s Fund reveals the growing burden of the State Pension on the public finances.

“With an ageing population, the UK faces a significant challenge of a proportionately shrinking working age population financing more pensioners. Combining this challenge with a Triple Lock which has generated significant uplifts in recent years, means the Government should be concerned about the future viability of the National Insurance Fund.

“While it would be a significant political risk to endanger the Triple Lock now, its current format could be increasingly challenging for the Treasury to sustain. For workers, it emphasises the ever-increasing necessity of building up adequate personal pension savings to ensure a decent standard of living in later life.”

|