Analysis of the latest quarterly Private Healthcare Information Network (PHIN) data1 by Broadstone, the leading independent pensions, investment, and employee benefits consultancy, finds that private healthcare admissions could exceed 900,000 a year by the end of 2024.

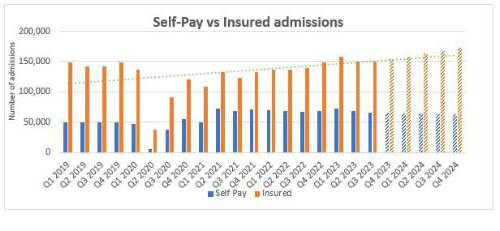

Analysis of the data found that insured admissions increased to 458,000 through the first three quarters of the year, an 11% rise from the 412,000 recorded in 2022. It means insured admissions are likely to surpass 610,000 through FY 2023, a record annual level.

Growth has been driven by surging corporate demand for private healthcare solutions from employers who no longer trust the NHS to secure the health of their employees, with the UK’s public healthcare crisis driving increased sickness absence, low productivity and economic inactivity due to ill health.

“A physically and mentally well workforce is critical to any business’ success. The crisis in the NHS means that employers are having to take matters into their own hands and invest in private healthcare solutions that give their employees access to the medical treatment they need, at the time they need it,” said Brett Hill, Head of Health and Protection at Broadstone

“We continue to see huge demand for the expansion of company healthcare schemes to cover more employees, and for preventative services like health screening programmes which can help catch illnesses early and avoid the more complex or chronic health conditions that are so damaging to the economic health of the country.”

In comparison, self-pay admissions are plateauing due to a natural limit on the amount of people able to fund expensive treatments entirely out of their own pocket.

In Q1-Q3 2023, there were 207,000 self-pay admissions compared to 206,000 through the first three quarters of 2022.

If the annualised rate of growth recorded over the past 12 months of available data were to be continued (11% for insured admissions and 0.4% for self-pay), total private healthcare admissions would reach 917,000 in 2024 (up from an expected 882,000 in 2023), of which 661,000 would be PMI-funded.

Brett Hill added: “We now face the realistic prospect of one million private healthcare admissions every year, primarily driven by the rise in PMI-funded treatments.

“It demonstrates the rapid pace at which UK businesses have pivoted towards investment in private healthcare services in recent years, and this looks set to be a trend that will only gather momentum.

“We see no silver bullet for the NHS. Waiting lists are expected to remain high meaning patients risk missing out on diagnoses, delayed treatment, and health issues evolving into more chronic and sadly even life threatening conditions in some cases. The UK economy can ill afford the impact this is having on its workforce, and more and more businesses are waking up to that fact.”

|