By Sachin Patel, Head of DB Corporate Consulting, Aimee Leese, Senior Actuarial Consultant, Ish Nakagawa, Associate Actuarial Consultant, Hymans Robertson

At the same time, alternative risk transfer solutions have gained real market traction with new legislation on DB superfunds included in the bill and high-profile transactions showing these options now have credibility. For corporates, the pace of change is hard to ignore and staying ahead of it is vital to ensure pensions don’t become a drag on wider business strategy. Our survey shows exactly this, corporate flexibility tops the agenda for companies with DB pension schemes.

Hymans Robertson research survey of 500 corporate decision makers conducted in 2025, and insights from the Hymans Robertson webinar “Future-proofing your corporate DB pension run-on strategy.”

Corporate flexibility emerges as the dominant DB priority

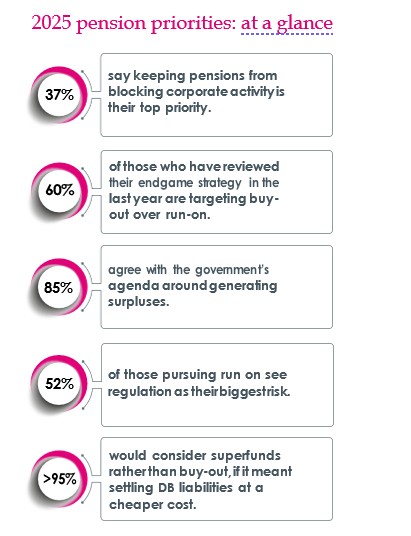

Our survey reveals a decisive shift in corporate pension priorities. When asked to rank their top priorities in DB pensions over the next three years, 37% of sponsors identified ensuring the pension scheme doesn’t obstruct broader business activity, as their leading focus. This surpasses compliance with new regulatory requirements (29%) and endgame planning (20%).

This trend highlights the growing alignment between pension strategy and corporate objectives. Sponsors are increasingly recognising that pension governance must support and not hinder strategic agility. Early engagement with trustees is essential to embed this flexibility and avoid pensions becoming a blocker at critical business junctures. Interestingly, endgame planning has dropped in priority compared to previous years, down from 27% to 20%. This may reflect a purposeful pause (read more in our publication here) as sponsors await clarity on the draft Pension Schemes Bill, particularly around superfunds and surplus extraction. Alternatively, the recent rise in funding levels and the push for long-term strategy under the new funding code may have stabilised journey plans, allowing sponsors to focus their priorities elsewhere.

Buy-out demand remains strong, but alternatives are gaining ground

Among schemes actively reviewing their options, our survey shows a 60/40% preference for buy-out over run-on. Buy-out continues to appeal across scheme sizes due to the certainty and protection offered by the insurance regime. Even for the largest schemes, where buy-out remains a strong favourite.

With most schemes now in, or beyond, endgame planning, the challenge has shifted from strategy to execution.

Sponsors should establish joint working groups with trustees to ensure the chosen endgame aligns with broader corporate goals.

At the same time, alternative endgame solutions are gaining significant traction. Clara’s recent transactions, and TPT’s launch of their superfund solution, have demonstrated that superfunds and capital-backed journey plans can offer credible, lower-cost alternatives to buy-out. Over 95% of respondents indicated they would consider a superfund or a capital-backed journey plan option.

Sponsors now face a broader and more nuanced set of choices than ever before. The question is no longer simply how to reach buy-out, but which path best balances member security, cost efficiency, and corporate flexibility. These alternatives should be explored between corporates and trustees, not dismissed by default.

Many different flavours of run-on, but will the dynamic shift?

Policy innovation, coupled with stronger funding levels, has propelled surplus sharing into the mainstream. Agreement with the government’s agenda1 to encourage surplus generation has risen sharply, from 61% last year to 85% this year. This highlights a growing alignment between regulatory direction and corporate strategy.

At our recent webinar, 60%2 of sponsors pursuing run-on are targeting a 5 to 10 year timeframe. We expect these are schemes already fully funded on a buy-out basis and aiming to distribute surplus before pivoting to buy-out.

However, around 20% are looking at running on for over 20 years, likely looking to provide long-term value for key stakeholders and to support the government’s agenda.

Regulatory risk over the longer-term remains the top concern of those pursuing run-on, cited by 50% of respondents. This isn’t surprising given recent legislative developments and the heightened regulator powers from the 2021 Pensions Act. The remaining respondents pointed to investment and longevity as the other key risks they’re focused on. The industry is forming a clearer view of what a suitable run-on investment strategy could look like, subject to your overall objectives. However, approaches to managing longevity risk still differ widely, making it essential to understand the options as part of shaping your overall strategy.

Motivations for running on of those surveyed are varied. Some sponsors are aiming to share surplus with employers or DB members, while others are looking to fund defined contribution provision costs. For some, the decision is driven by a desire to manage the accounting implications of a buy-out or to avoid the premium associated with insurance. In other cases, the rationale reflects a more paternalistic employer philosophy, seeking to retain control and flexibility in supporting members over the longer term. As legislation and regulation stemming from the draft Pension Schemes Bill progresses and further guidance on surplus extraction becomes available, it will be interesting to observe how these dynamics and underlying motivations evolve.

Conclusions

Our survey shows corporate pension strategy is evolving fast. Sponsors are prioritising flexibility and exploring a wider range of endgame options as mainstream considerations. Given this backdrop, corporates should engage early and openly with trustees. Focusing on the details will ensure the endgame supports broader business aims. It also puts corporate sponsors in the best position to benefit from the opportunities this evolving pensions landscape presents.

For further information or support, please contact one of our corporate consulting team or get in touch here. For further insights on the endgame perspective, please refer to our Excellence in Endgame hub.

1 For DB pension schemes to consider not buying out at the first opportunity, but to instead keep going and generate surplus that can be distributed to members and back to employers. In addition, the government had hoped schemes will invest some assets back into the UK economy to generate these surpluses.

2 Hymans’ webinar ‘future-proofing your DB pension run-on strategy’

|