The increase means that someone looking to annuitise in recent weeks could expect to receive an annual income of £7,115 based on a £100,000 pension pot, an increase of £1,227 on the £5,888 they would have received in June of 2022.

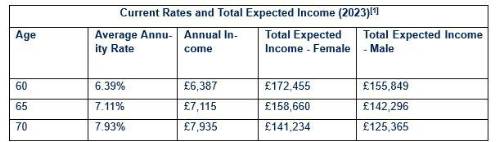

*Total expected income figure based on life expectancy statistics from the Office of National Statistics, are based on age annuity is first purchased. Total expected income includes annuity income only.

About the Annuity Rate Tracker

The Tracker, developed by Standard Life, part of Phoenix Group, monitors current average annuity rates across the market for those annuitising at aged 60, 65, and 70. It also shows the total lifetime income from an annuity and the extent to which annuity rates improve with age.

Total lifetime income

The Tracker found that total expected lifetime income for the average female who bought an annuity at 65 had increased from £130,707 in June of last year to £158,660 as of June 2023 – a difference of over £27,900. The equivalent figure for a male was £117,116 to £142,296 – a difference of over £25,000. Total expected income is based on life expectancies from ONS.

Improving rates with age

While purchasing an annuity earlier in retirement will result in higher income overall, annuity rates also increase with age. This means that those who decide to purchase one later in their retirement are likely to benefit from higher rates.

Based on today’s rates, the Tracker shows a 24% difference in annuity rates based on someone who chooses to annuitise at 60 versus 70. An individual purchasing an annuity at the age of 60 could expect to receive an annual income of £6,387, £7,115 at 65 and £7,935 at 70.

Awareness around annuity rates

The Tracker has been launched following research commissioned by Standard Life**, which asked over 50 years old about their retirement income plans. It found that most over 50s aware of annuities do not monitor rates (69%), with almost half (49%) reporting that they did not know if a particular rate was good value for money, while over half don’t know if they offer good or bad rates compared to 5-10 years ago.

The total annuity market was at its highest quarter since pension freedoms in Q1 2023, according to the ABI, with two thirds of the growth being driven by more customers and one third driven by higher average premiums.

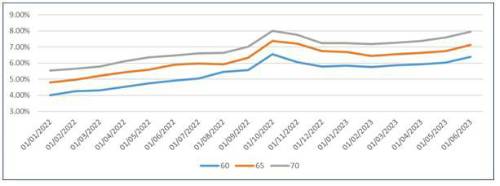

Average historic annuity rates for a healthy 60, 65, 70-year-old

Graph shows the increase in annuity rates since the start of 2020, split by ages 60, 65, and 70, as at June 2023.

Pete Cowell, Head of Annuities – Individual Retirement at Standard Life, said: “Annuity rates have improved significantly over the last year, meaning pension savers can get much more for their money than before. This, coupled with the certainty and security offered by a guaranteed income, makes the value offered by annuities hard to ignore, and especially in the current climate in which every penny counts. For those wishing to explore the value of an annuity, there is the possibility of annuitising at different points during retirement, allowing people to benefit from higher rates and greater income.

“We’re entering a new era of retirement income planning, in which we’re moving away from the notion of retirement income being a one and done approach. When it comes to retirement planning, people need to consider what they expect their retirement to look like, based on their individual circumstances, and work out how best to make the most of their retirement savings. What’s becoming more appealing is the idea of a blended approach, with annuities and drawdown working in combination to meet different needs in retirement. This approach allows a portion of savings left in flexible drawdown and with the potential to grow, and the annuitised portion providing an element of guarantee to cover essential costs in retirement.”

Standard Life Annuity Tracker July 2023

|