By Fiona Tait, Technical Director, Intelligent Pensions

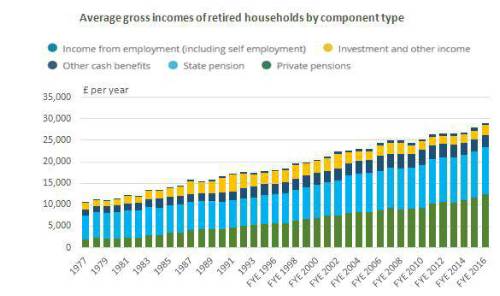

Note - Years are calendar years until 1993 and financial years thereafter. Therefore, 1995 refers to financial year ending 1995 (April 1994 to March 1995) through to 2016, which refers to financial year ending 2016 (April 2015 to March 2016)

In 2016 private pension saving accounted for 43% of the income for a retired household, compared with 17% in 1977 when the largest component of income (53%) came from the State Pension. Given the inevitable and well-publicised increases to the State Pension Age this is a very positive picture, the question is, can it last??

Role of the State

The above picture is undoubtedly what the government would like to see. The current administration believes that the purpose of the State Pension is to keep pensioners out of poverty. Those who want a comfortable retirement should take responsibility and save for their own future.

A more left-leaning government would probably want to increase the role of the state however the increasing numbers of older people in the population make it unlikely that they could, at least so long as it remains a universal benefit. Either way, people should probably not bank on having a State Pension available when they want it or as much as they want it to be.

Role of family

The obvious flaw in my comparison above is that the retired figures refer to a household whereas the earnings figures refer to individuals. Whilst not suggesting this provides a statistically valid comparison I believe the picture it presents is not wholly inaccurate since in the majority of retired households there is likely to be only one partner with private pension savings.

Going forward a family unit is more likely to have two partners with earnings and/or retirement savings however research from the Wellbeing, Health, Retirement and Lifecourse project shows that families with children are still likely to rely more on one partner for their main income. A bigger issue is how to restore the balance if and when that family unit is broken.

Private pension saving

So that leaves us with private pension saving – voluntary or otherwise. The picture above looks good but those who take comfort from it must remember that it is based on a cohort of savers who are much more likely to have defined benefits pensions. Another set of ONS figures shows that in 2015 the average total contribution rate into DB schemes was 21.2% of pensionable earnings whereas for DC schemes it was only 4.0%.

The lower DC saving rate will improve as higher minimum contribution rates are phased in under automatic enrolment (AE) but it needs to go much further. The current review into AE is not considering the minimum contribution rate but it must recommend that someone does so, and soon. To support this both government and industry should also remove the more obvious disincentives to saving:

• Over-complexity of tax rules, in particular the additional restrictions on the annual allowance and inconsistencies between the way the lifetime allowance applies to DB and DC schemes

• Difficulty in accessing clear and consistent information about pension savings, often driven by the need to “cover all bases” rather than providing clarity to the consumer.

• Constant changes to legislation which make it impossible for savers to picture what retirement will actually look like in the future. Get it right, then leave it alone.

There is no avoiding this, private pension savings are the key to a comfortable retirement. Whether the money comes directly from individual pension contributions or less explicitly via changes to remuneration packages or increased taxation, it will have to come from somewhere and one way or another the individual is likely to foot a large part of the bill.

|