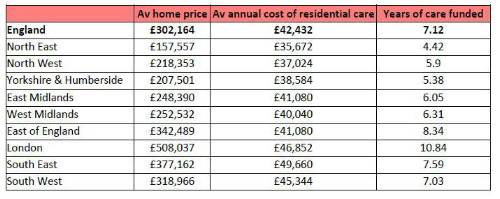

Selling the average home in England will provide enough cash to pay for about seven years of care in a residential home, new analysis by retirement specialist Just Group suggests.

But with care cost increases outstripping property price rises, the number of years covered is gradually reducing, potentially undermining the plans of people planning to self-fund their care needs by selling their homes.

Although average house prices in England have risen by around 12% since 2020/21 to more than £300,000 by the end of last year, the weekly cost of care in a residential home has risen by about 20% to £816 a week in the same time period.

The analysis found that care costs increases have outstripped house price rises in all English regions over the period, particularly in London where average home prices have risen just 3% compared to care cost rises of 17%.

“The home is often the most valuable asset which, under current rules, makes it a major source of finance for people funding their own care,” said Stephen Lowe, group communications director at Just Group.

“Research for our annual Care Report found homeowners aged 45+ were more likely to see selling their home as a source of funding than any other option such as pensions, investments or the State. That makes average house value compared to care cost an interesting metric to track.”

“Our analysis shows selling the average home in England could pay for about seven years of residential care but there is evidence of a North-South divide. In the North East it is four years while in London it is nearly 11 years,” said Stephen Lowe.

“These are optimistic figures because in the real-world self-funders meeting all their own costs pay higher fees than those receiving some or all council funding, while the costs would be higher still if specialist nursing care were needed.”

The ‘house price to care cost’ ratio is a useful measure because currently about half of care home residents pay all their own fees and a significant amount of funding is sourced from people selling their homes when they go into a care home.

Research among homeowners aged 45+ for the Just Group Care Report 20233 found property a more common source of potential care funding than any other option. Asked how they would pay if they went into a care home in the future, the most common option (40%) was that people would sell their homes to pay for care.

“Under the current means-tested social care system, those with assets of more than £23,250 have to pay for their own care and this will include their residence unless it is still being lived in by someone such as a spouse,” said Stephen Lowe.

“Most people haven’t made alternative plans for paying for care. Reforms that might have helped to protect the value of the home have been delayed and may never be implemented. That means the onus remains on people to find the funds where they can, which is often the home.

“The care sector is facing huge funding pressures and, as we head towards a General Election, voters should look at what answers the politicians are suggesting. People need certainty so they can stop fearing the future and start planning for it.”

|