By Fiona Tait, Financial Director, Intelligent Pensions

It also tackles consumer confidence that “it won’t happen to me” head on and shows just how easily it could happen to you.

Trustees could do a lot worse than showing this at member meetings and/or putting it on their website.

There is however a lot more to do. The advert addresses the first part of the equation - it tells people what not to do. What the majority of communications, and also trustees, are less good at is telling people in a meaningful and helpful way what they should be doing.

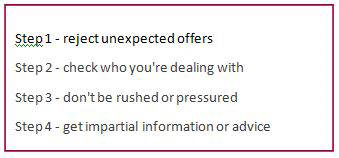

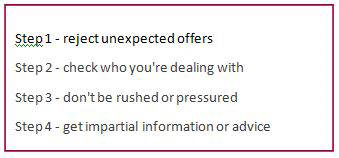

The advert, and the ScamSmart leaflets direct the consumer, quite rightly, towards the FCA and The Pension Regulator websites. Both lead to a ScamSmart page which suggest 4 simple steps to protect against pension scams:

This is a good start, but it could be better.

Step 1 states “If you get a cold call about your pension, the safest thing to do is to hang up” and refers to the proposed ban on cold-calling. Trustees can and should be saying the same thing to their members, but it would be even stronger if the ban was actually in place and they could say, unequivocally, that any cold call regarding your pension is illegal and should be ignored.

Step 2 includes

Step 2 includes a link to the FCA register of financial advisers, which is very helpful as research shows most people have no idea where to even start looking for one. Trustees can also refer their members to the register in the knowledge that it is non-commercial and overseen by the regulating body.

There have also been 2 very positive decisions from the FCA recently:

1. Their original intention to remove individual regulated financial advisers (RIs) from the register appears to have been dropped. This is good because people deal with people, not corporate entities. It also makes it harder for a rogue adviser to hide behind a legitimate firm.

2. They have recently introduced a search facility which allow people to find advisers in their local area. This should be extremely helpful; most people still prefer to deal with another person who they have something in common with and who is likely to know more about local businesses and employers. Even if they choose to deal online it is good to know they could have an initial meeting and or face to face discussions should they have a specific advice issue to discuss.

It is therefore unfortunate that much of this is undermined by the format of the register which is text-heavy and obviously based on the definitions used by professional firms when reporting to the FCA. This not only makes the information difficult to understand, assuming they’re not put off reading it at all, it could be unintentionally misleading. The terms “Appointed Representative” and “Tied Agent” mean nothing to the standard pension scheme member, let alone the difference between advice and guidance. If adviser firms are struggling with the boundaries around this, what chance do scheme members have?

Many entries also refer to “requirements or restrictions” which “can include suspensions”. This is not an indication that these firms have been suspended, in most cases it means that the firm is not authorised to hold client money. Ironically this which is intended to provide further consumer protection could lead consumers to infer they should avoid these firms.

Overall there’s some good stuff here but it does need some work to make it consumer-friendly. In common with the rest of the consumer-facing part of their website the register could perhaps benefit from less content and more clarity. It can be done and the Money Advice Service (MAS) is a great example of this.

This brings me to the last issue. The register absolutely has to be accurate. Obviously the Regulator will do its best, but advisers also need to check their entry, on a regular basis, to ensure it is correct and up to date. That way trustees will be able to direct their members with confidence and members will be able to find the support they need.

|

2. They have recently introduced a search facility which allow people to find advisers in their local area. This should be extremely helpful; most people still prefer to deal with another person who they have something in common with and who is likely to know more about local businesses and employers. Even if they choose to deal online it is good to know they could have an initial meeting and or face to face discussions should they have a specific advice issue to discuss.

2. They have recently introduced a search facility which allow people to find advisers in their local area. This should be extremely helpful; most people still prefer to deal with another person who they have something in common with and who is likely to know more about local businesses and employers. Even if they choose to deal online it is good to know they could have an initial meeting and or face to face discussions should they have a specific advice issue to discuss.