By Alicia Drewitt, Head of Innovation and Acceleration – FINEX at WTW

According to our recent Directors’ and Officers’ (D&O) survey, cost was identified as the primary factor influencing the amount of D&O insurance clients decide to purchase, cited twice as frequently as the quantification of potential liability.

Cost-saving measures: Short-term gains vs long-term implications

Strategies such as reducing insurance limits, increasing deductibles, or eliminating certain policy types can lead to immediate cost reductions. However, the critical question remains: Are these strategies cost-effective in the long run?

A case study: The hidden cost of reducing cover

Consider this scenario: An organisation, aiming to cut costs and influenced by the absence of recent claims, decides to forego renewing its Crime policy. Later that year, an internal audit reveals that a disgruntled employee had misappropriated funds through a series of wire transfers. The employee, who had been working in the accounting department, had created a competitor company to siphon money from clients. By the time the fraud was detected, the employee had already left the company.

$1.2M average cost of internal theft and fraud events to organisations

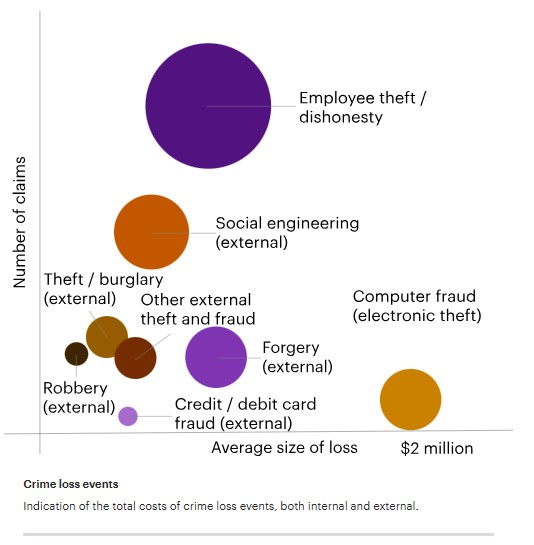

Though such events might seem infrequent, our experience shows that employee dishonesty is the most common type of claim under Crime policies. Employees with deep knowledge of internal systems can conceal their fraudulent activities, increasing both the duration and magnitude of losses. This risk is heightened during economic crises when financial pressures can drive employees to dishonest actions. On average, internal theft and fraud events cost organisations US$1.2 million, with the largest single loss reported at US$110 million. With budgets squeezed, risk managers face the question: When is reducing cover the right decision?

The graph below shows the types of crime losses, both internal and external, by frequency (vertical axis) and average size of loss (horizontal axis). The size of the bubble represents the total costs of the loss event.

Data-driven decision making: Aligning strategy with risk

Access to robust data is crucial for informed decision-making. Aligning your insurance purchasing strategies with your risk profile can deliver better outcomes and enhance the value derived from the expenditure. While the cost of not purchasing appropriate insurance can far exceed the investment in such coverage, understanding the return on investment is essential. This is especially critical when budgets are tight, and costs are rising. Insurance purchasing should be driven by risk assessment and a comprehensive cost-benefit analysis.

Performing a cost-benefit analysis

A straightforward process for a cost-benefit analysis includes:

Identifying risks: Identifying the specific risks your organisation faces and examining claim trends to pinpoint gaps in your perception of risk.

Insurance policies: Determining the insurance policies that address these risks. Analyse how insurance is likely to respond and consider changes to coverage wordings for enhanced protection.

Insurable risk profile: Assessing the insurable portions of your risk profile.

Budget allocation: Allocating spending in areas that maximise the budget’s impact.

Optimising insurance placements

Navigating economic pressures and insurance purchasing strategies requires a balanced approach that considers both immediate cost savings and long-term risk management. By leveraging data and performing thorough cost-benefit analyses, organisations can make informed decisions that protect their financial health and ensure comprehensive risk coverage.

Conclusion

Our FINEX Operational Risk Solutions team collaborates with firms to tailor their insurance placements to their unique risk profiles and financial positions, thereby providing enhanced risk coverage.

|