By Fiona Tait, Business Development Manager, Scottish Life By Fiona Tait, Business Development Manager, Scottish Life

The main result for the pension industry of the Chancellor’s 2012 Budget statement is, thankfully, business as usual. In the run up to George Osborne’s speech the usual concerns that higher rate tax relief might be removed were given considerable impetus by Danny Alexander , but were in the event specifically ruled out .

Private pensions

The future of private pension planning in the UK will be dominated by automatic enrolment and the knock-on effect for existing pension savings. One of the strongest arguments against a change to the tax rules for pensions was that it might have a detrimental effect on the number of employees who choose to opt out of their employer’s scheme. This would be politically damaging to the government and, even worse, detrimental to the lifestyle and income of those individuals in retirement.

There will of course be implications for automatic enrolment as a result of this Budget, following confirmation by the Department of Work & Pensions (DWP) that the qualifying and band earnings thresholds will be linked, at least initially, to the Personal Allowance (PA) and upper and lower National Insurance (NI) contribution limits respectively .

The increase in the PA means fewer lower paid workers will be automatically enrolled (which may lead to savings for some employers). However the upper NI contribution limit of £42,475 is significantly higher than the originally proposed upper earnings threshold of £35,853.

For individuals, there are still opportunities to utilise pensions as part of their tax planning. The delay in the reduction of the highest rate of income tax, from 50% to 45% in April 2013, provides an incentive to make a substantial pension contribution in the current tax year, particularly where there is unused annual allowance available to be carried forward.

The reduction in child benefit for individuals earning over £50,000 provides a further incentive, since a pension contribution could bring net earnings under this threshold.

State pensions

The announcement that the state pension age (SPA) will in future be increased to take into account improvements in longevity was probably inevitable at some stage, as people spend longer and longer in retirement.

What hasn’t been confirmed is exactly what form these increases will take. (There will be a further consultation as part of the Office for Budget Responsibility’s 2012 Fiscal sustainability report.) On the one hand, the increases could be linked to a relevant index, such as the ONS National Interim Life Tables. Alternatively, the government could commit to revising the limit at agreed intervals. The former approach would have the advantage of consistency and provide a degree of predictability; the latter would be simpler to implement and understand, but may lead to anomalies for individuals who are looking to retire just before or just after the review. It would therefore be sensible for the new limits to take effect after a prescribed period of time, and I would advocate that reviews take place regularly enough that they become an expected part of government strategy, and not the nasty shock that the removal of age-related personal allowances proved to be.

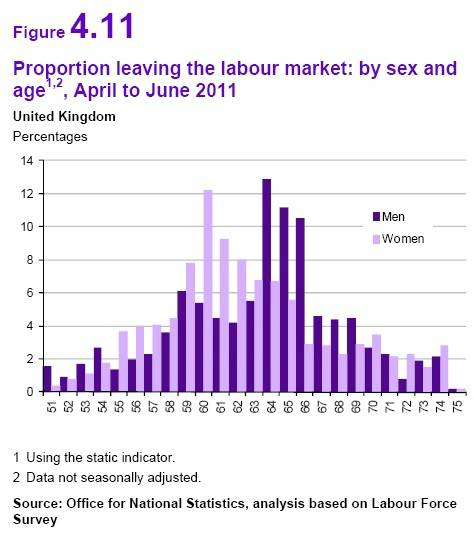

The state pension age is emotive and has massive implications for individuals. Evidence shows that the vast majority of people still retire on or close to the SPA, suggesting that many still rely on the state pension to fund their income needs in retirement. There may also be an element of belief on the part of individuals that the SPA is the age at which they “should” retire. This impression may well be starting to change, particularly for women, as people reach SPA and find they have insufficient savings to retire, either in full or in part. The state pension age is emotive and has massive implications for individuals. Evidence shows that the vast majority of people still retire on or close to the SPA, suggesting that many still rely on the state pension to fund their income needs in retirement. There may also be an element of belief on the part of individuals that the SPA is the age at which they “should” retire. This impression may well be starting to change, particularly for women, as people reach SPA and find they have insufficient savings to retire, either in full or in part.

The change to a flat rate state pension should be helpful, making it much easier for individuals to predict their income in retirement, and to assess whether they need to augment it. In the majority of cases the answer will be yes, since most people will aspire to an income of more than £140 per week (£7,280 per annum). Hopefully it might encourage people to think in terms of ongoing income. And it should also provide some context to the “telephone number” projections of fund values that can easily mislead individuals to believe that minimal savings are required to achieve the living standard they would like to maintain in retirement.

In the longer term, retirement planning could be made even simpler if the NI and income tax systems were to be merged. The government has pledged to consult on this which is generally a very positive move, even if it does mean we’d be back to square one on automatic enrolment earnings bands!

Summary

• It’s largely “business as usual” for pensions following the 2012 Budget

• Tax reliefs remain unchanged in the lead up to automatic enrolment

• A higher personal allowance means fewer low-earning workers will be automatically enrolled

• Linking the state pension age to longevity will lead to people retiring later, although the mechanism for the linkage has yet to be decided

• A flat rate state pension should make it easier for individuals to plan for their retirement

|