In parts 1 (see here) & 2 (see here), we explored how insurance carriers are managing the disruptive process of Connected Claims transformation, and how this is taking shape with respect to current and future levels of investment.

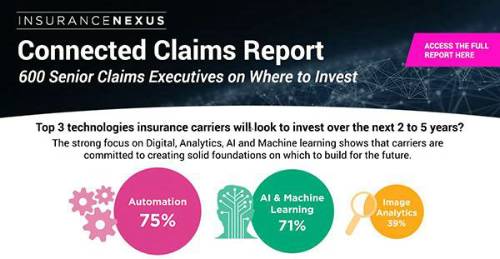

We now turn to the future, examining which technologies insurance carriers will rely on to make Connected Claims a reality. Digital, Data, Claims Technology and AI all look set to be prioritized by carriers worldwide (all four being key components of any Connected Claims strategy) but as we have seen, much investment has already taken place in these areas. As the technology matures, we can expect to see divergences in the routes taken, reflecting the differences in various markets and progress to date.

Accordingly, our research found some interesting differences between North America and Europe, regarding the technologies each will prioritize over the coming decade. Although insurers on both sides of the Atlantic will be investing heavily in AI over this period, European carriers placed AI as their number one priority, with Claims Systems and Data taking precedence in North America.

This reflects significant differences between the two markets; North American carriers often cite the influence of brokers who make it difficult to form relationships with (and by extension, acquire the data of), their end customers. In Europe, the relationship between insurers and customers is more direct and so the flow of customer information and interaction is largely unencumbered.

Thus, European carriers are now able to focus on the insights they can derive from that data using AI systems, while their North American counterparts are more concerned with having the foundations of data and claims systems in place first. This is borne out by the fact that over the next five to 10 years, North American carriers will look to invest in AI and Automation much more heavily than in Europe, but only once issues around data infrastructure are resolved.

• The core technologies upon which Connected Claims transformation will be built/predicated, and how this differs in North American and European markets

• The effects of introducing AI on the workforce: just how many jobs may be lost to AI (hint: it’s fewer than you may think)

• Investment trends in the short and long-term: how will investment levels change over time, and what does this suggest about current priorities for insurance carriers?

• With core technologies in place, where will carriers turn for long-term success?

I hope you enjoy the report!

Mariana

|