By Fiona Tait, Technical Director, Intelligent Pensions

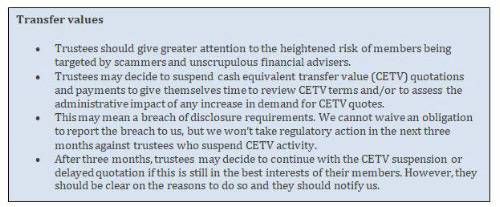

The reasons given for this action are:

1. To give trustees the time to review CETV terms and/or to assess the administrative impact of any increase in demand for CETVs.

2. If a suspension is in the best interests of their members.

Certainly, it should make life easier for trustees and administrators but is it really in the interests of the normal scheme member?

Financial advice

Even though this suspension will impact the income stream of financial advice firms, there are other factors at play which mean we might be glad to see the back of them for a while.

Increased regulatory focus means the time spent on each individual case, coupled with the exorbitant cost and lack of availability of Professional Indemnity Insurance, has already reduced profitability in this area of business to potentially unsupportable levels.

The coronavirus effect has only added to the practical difficulties and time required to advise on and implement pension transfers.

Unfortunately, the result is unlikely to improve access to advice for the majority of members.

Needs and objectives

Clients have many reasons why they think a pension transfer might be in their interest, some of which are very justified.

On top of these we now have people who are in financial difficulty because their income stream has dried up during the current crisis. Using pension assets is, and should be, a last resort but there are some circumstances where this may not be possible. The suspension could therefore mean the removal of a lifeline for some.

Other clients may be worried about the solvency of their employer. Although we would not generally consider this to be a good reason to give up a guaranteed income stream, it does mean spending more time on informing them about the availability of the Pension Protection Fund, how it works and the security it can provide.

Attitude to risk (AtR)

Assessing AtR is not easy at the best of times but it would be a rare client who is unaffected by recent market turmoil. Capacity for loss is mathematical and should not change however, an individual’s personal loss tolerance may well do. Crash tests are also problematic – we are effectively illustrating a 30% loss on top of a fall in equity markets during 2020 that is almost of that order already.

This may not be a bad thing; if clients are nervous about risk then a transfer is much less likely to be suitable for them but what we are seeing is more “I do want to transfer but want to keep it in cash for now” rather than “I don’t want to transfer at all”. Once again, we need to take time to explain that pensions are a long-term investment.

Fair value

Another timing issue is the fact that CETVs have a finite lifespan, and it is challenging to get a report and recommendation out in time even when we can rely on first class post. We would never recommend a client to transfer just because the valuation is high, but if a transfer is in the client’s interests then we want to effect it at a time when the client is getting good value.

At the time of writing it is unclear whether trustees can suspend payment on existing CETVs where the paperwork is submitted ahead of the Guaranteed Retirement Date. It would seem most unfair if a client who has waited over 2 months to obtain their report suddenly finds they are unable to proceed or have to wait and begin all over again with the possibility of a reduced transfer value.

Vulnerability

Added to all of this, we also have to consider that significantly more clients could be classed as vulnerable. If they are financially stressed, they are much more likely to prioritise a short-term fix over long-term security and be inclined towards making poor financial decisions, not just about transferring to a defined contribution scheme but also very much which assets they transfer into.

Conditions like these are unfortunately ideal for scammers who will be doing their best to promote their highly suspect solutions.

Scams are one of the reasons given to support the suspension however, the issue here is more about the nature of the investments than the structure of benefits. It is unfortunate therefore that recent activity from tPR’s sister organisation has led to a huge reduction in the availability of financial advice and even though we lost some of the bad guys, we almost certainly lost some of the good guys too.

In summary, it’s a very difficult environment. Ultimately, though it should be about what will help scheme members to manage their finances most effectively and not what makes it easier for the industry.

|