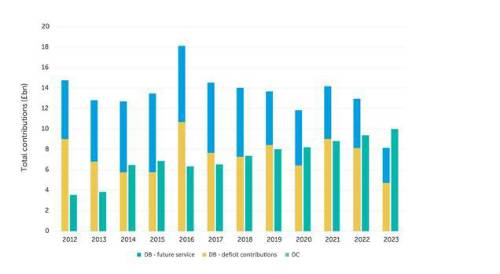

BW conducted an analysis of the FTSE 350 companies with DB pension schemes over the last twelve months to 31 May 2024. The data reveals that contributions totalling £8.1 billion were paid into DB schemes (consisting of £4.7bn of deficit contributions and £3.4bn of DB pension accrual contributions) while £9.9 billion was paid into DC schemes.

This historic shift is a consequence of the increase in Government bond yields over recent years which has improved FTSE 350 DB schemes funding positions (and therefore reduced the deficit contributions paid by scheme sponsors) and reduced the cost of DB benefit accrual.

Analysis from Barnett Waddingham

Lewys Curteis, Principal at Barnett Waddingham, said: “The contribution data signals a decisive moment in the pension industry. While DC has been the preferred form of pension benefit in the private sector for many years, it is only this year that DC contributions have exceeded DB contributions for the FTSE 350 DB scheme sponsors.

To be clear, this is the consequence of a large fall in DB contributions, reflecting the material improvement in funding positions and the reduction in the cost of DB pension accrual, rather than a step up in the level of DC contributions being paid. Concerns about DC pension adequacy remain, with the level of contributions generally considered to be too low to support good member outcomes. The reduction in DB pension costs and the emergence of DB scheme surpluses could provide companies with the means to redress this imbalance without materially impacting the bottom line.”

BW advises on risk, pensions, investment, insurance, and employee benefit services. The consultancy acts as a trusted partner for a wide range of clients in both the private and public sectors – this includes 25% of FTSE 100 and over 15% of FTSE 350 companies.

|