By Hugo Gravell, Principal and Investment Consultant and Umang Rajbhandari, Investment Consultant and Head of Alternative Investment Research, Barnett Waddingham

"The average allocation to private markets during the growth phase of master trust default strategies has increased to around 6% of assets – a clear sign of momentum, though around half of this remains in property. Crucially, access is not limited to the largest players."

With the recent Mansion House Accord and the Pension Schemes Bill keeping the spotlight on private markets, our focus as an industry needs to move on from debating the role for private markets. We must focus on achieving value for members.

Delivering value through a strategic asset mix that prioritises growth

Long-Term Asset Funds (LTAFs) were introduced as the go-to solution for DC schemes seeking private market exposure. Designed to accommodate DC-specific constraints, regulated by the FCA, and offering semi-liquid structures, they represent a well-intentioned innovation.

"As of May 2025, approximately £11 billion has been committed to LTAFs, with around £3 billion deployed – early but meaningful progress."

However, not all LTAFs are created equal. Trustees must go beyond the label and assess whether the underlying portfolio is delivering real value for members.

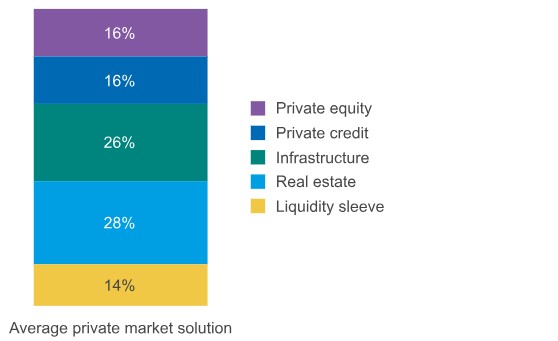

The chart shows the average allocation for FCA authorised multi-asset LTAFs:

Source: Fund Managers

In our view, too little is being allocated to private equity. Of the private market asset classes, it has the highest expected return, which suits the objective of younger members who will primarily be invested in these funds.

Some LTAFs offer private equity-only exposure but are often skewed toward venture capital – a high-risk starting point. We prefer a more measured approach, beginning with more established strategies like buyout and growth, while gradually building the capabilities needed to explore more niche areas over time. Private markets are more complex and require significant expertise – DC schemes must not run before they can walk.

More fundamentally, LTAFs are part of the solution – but they should be selected based on merit, not momentum. Importantly, they’re not the only game in town, and we prefer alternative structures.

Delivering value through manager selection

To complement our deep understanding of the DC market (see here), our private market research team have engaged with over 150 managers in the past year, many of whom are entering the DC universe for the first time. These conversations have reinforced some of the themes and considerations that are essential for achieving value for members:

1. In-house bias can limit choice

DC workplace pension providers often lean toward in-house strategies. This can lower costs – but may restrict diversification and cut off access to high-performing external managers and strategies that best fit member needs.

2. Experience matters in manager selection

Fund-of-funds managers can bring deeper expertise and stronger manager selection capabilities than some DC workplace pension providers with limited track records. Compounded by fears that DC schemes will become a dumping ground for unloved private assets, clear manager selection processes and oversight are vital.

3. Open-ended structures may narrow the opportunity set

Some managers only allocate through open-ended funds. These enable regular subscription and redemptions but will limit exposure to certain assets and strategies. A blend of open and closed-ended funds is possible.

4. Co-investment presents real value

Ensuring your manager can co-invest on your behalf can help lower fees – an attractive feature for cost-conscious DC schemes. By using a fund-of-funds manager that accesses co-investment, schemes can manage their governance budget while increasing long-term value potential.

5. Fair value across member cohorts

Perhaps one of the bigger challenges with introducing certain assets into DC defaults. However, with careful planning, trustees can be confident that different cohorts of members are treated fairly. Perfection doesn’t exist – but member outcomes already owe a lot to market conditions during their working life. In our experience, you can work with managers to find a model that works.

Delivering value as the DC market evolves

DC workplace pension providers will remain central to shaping private market access in DC. While many are not traditionally private market specialists, many are developing bespoke mandates for their master trust and contract-based arrangements.

This could create fundraising challenges for pooled funds not aligned with major providers. Own trust schemes may worry that this will leave them scratching their heads: if less competition between fewer large schemes results in less choice, will trustees be confident they can find a credible manager? Rest assured, our conversations across the market have demonstrated that managers can help schemes design their own solutions, even at smaller scale.

Operational design is also under the spotlight. Fidelity’s recent decision to move away from their life platform model underscores the need for flexible, cost-efficient platforms that can support both liquid and illiquid assets. With only a few exceptions, life platforms have been the bedrock of the DC market. With the potential for additional flexibility to support innovative decumulation solutions too, we would encourage all DC providers to review their operating model to make sure it can support increasingly sophisticated investment strategies.

And then there’s scale. We are challenging providers and managers on their ability to scale strategies thoughtfully – particularly around pipeline planning, vintage diversification, and governance oversight. We expect to see more focus on in-house capabilities as private markets become a core feature of DC investing.

What does this mean for you?

Private markets are no longer a peripheral allocation in DC – they are increasingly central to long-term strategy. The focus now must shift from access to execution: choosing the right vehicles, selecting the right managers, and aligning with member interests. This is the new DC playbook. One where value for members will come, not just from market access, but from quality access.

So, what does this mean for you? Ask yourself:

Is your DC scheme allocating enough to private markets?

Are you confident your asset manager is equipped to deliver long-term value for members?

|