New research from Shepherds Friendly suggests extra benefits related to health could help increase the persistently low take-up of Income Protection (IP) among the British workforce. A survey of 2,000 people carried out for the friendly society in October found that just 14% of UK adults who are working full time have IP. This type of insurance had the lowest take-up of the insurance products covered by the survey.

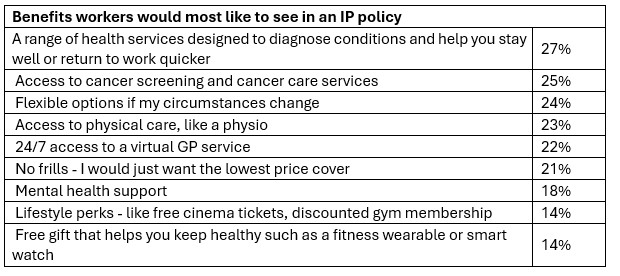

In comparison, 78% of full-time workers have car insurance, 60% have contents insurance, 56% have building insurance, 45% have life insurance, 37% have pet insurance and 36% have health insurance. Those who do not have IP were asked which of a range of benefits they would be most interested in if considering such a policy, with services related to health topping the list.

There were some notable variances among the age groups surveyed, with younger people favouring adaptability. Some 33% and 29% of 18-24-year-olds and 25-34-year-olds, respectively, said they wanted flexible options in case their circumstances changed. Younger respondents are also more likely to want a 24/7 Virtual GP service, with 28% of 25-34-year-olds citing this as a preferred benefit.

The number of respondents who said they just wanted the lowest price increased with age, peaking among those aged 55-64, suggesting cost effectiveness is more important than added features for these workers. Workers in this age group are the least likely to have IP, with just 7% reporting they have a policy. Those aged 25-34 are most likely to have cover at 20%, closely followed by 35-44-year-olds at 18%. Some 14% of 18-24-year-olds have IP, but this falls to 10% in the 45-54 age group.

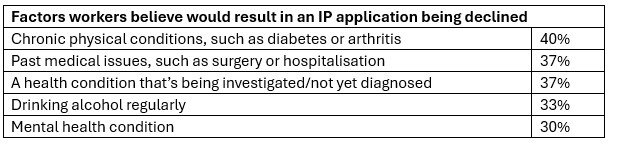

Despite its low take-up, the survey revealed that the vast majority of workers (70%) are aware of the product, meaning lack of awareness is unlikely to be the reason employees are failing to safeguard their earnings. Instead, the survey findings suggest incorrect assumptions about what might prevent someone being accepted for a policy could be to blame. Some 47% of respondents said they believed someone’s current or past lifestyle, physical health or mental health would automatically prevent them from being accepted for IP, with this assumption highest among those aged 35-54 (51%).

There are also widespread misconceptions about what is covered IP. While 69% of respondents think IP pays one’s salary if they are sick or injured, 42% incorrectly believe it pays out in the case of redundancy. A further 13% believe it pays off one’s mortgage, 12% think it pays out a lump sum in case of death and 12% are under the impression it covers medical bills.

Phil Nash, Chief Sales Officer at Shepherds Friendly, said: “It’s well-known that Income Protection is underutilised, but it’s often assumed this is due to a lack of awareness. The results of this survey were therefore striking in revealing the level of misconceptions surrounding the product. It is concerning that workers are more likely to insure their pets than their income. However, many people already have health insurance, and others are interested in health add-ons. This shows there’s a real chance to grow income protection take-up by making sure extra benefits fit what workers want.”

|