By Iain Pearce, Head of Alternative Risk Transfer at Hymans Robertson

Schemes close to buy-out:

Schemes that have been moving steadily towards full funding on buy-out will typically have a de-risked portfolio that is designed to ultimately pay the buy-out premium (either transferred to the insurer or sold for cash), and will be well hedged to movements in interest rates with low levels of leverage. As a result, they are well placed to weather the current volatility. However, the material changes in yields will magnify any differences in hedging strategies between the insurers and schemes and so could create an unwelcome headwind for those schemes that were very close to being able to transact.

On the other hand, schemes that were further away from buy-out and were underhedged to interest rates will have seen a rapid improvement in their funding level and are likely to be executing plans to lock in these gains and accelerate their preparations for buy-out.

Schemes targeting a partial buy-in:

These schemes typically have a mixture of growth and hedging assets. This is because they will have a wider strategy to grow the assets to able to afford to fully insure all benefits at some point in the future. Usually the hedging part of the portfolio will include at least some leveraged LDI assets, which have mirrored the rapid falls in the value of long dated gilts and swaps. Whilst funding levels may not have been impacted, the hedging assets that were set aside to fund the buy-in may now be required as collateral within the LDI portfolio. This could well lead to a review of the planned buy-in, and in many cases a decision to reduce the size or defer the buy-in.

Altogether, the market dynamics are likely to still result in a very busy market de-risking market, but where a number of transactions are reassessed with some slowing down and some accelerating. Overall, we would expect these changes to further the trend where buy-outs make up an increasing share of the overall market.

But how have insurers been impacted?

As is often the case, the high levels of capitalisation and regulation for UK insurers mean that they are able to weather volatility better than the average pension scheme.

Pension schemes can take a lot of comfort from knowing that the Solvency II Matching Adjustment regime effectively requires insurers to adopt a “buy and hold” cashflow matching strategy. This means that insurers don’t hold the same scale of leveraged hedging positions that are currently hurting many pension schemes. In addition, these cashflow matching strategies will have been more resilient to market movements than typical pension scheme portfolios.

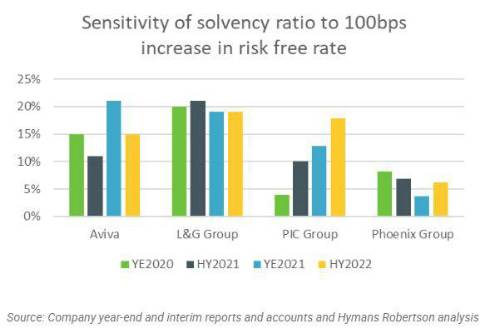

While recent interest rate movements will mean insurer portfolios have been well hedged, the capital that insurers are required to hold above their liabilities will also have shrunk as interest rates rise, without a similar fall in the assets set aside to cover these capital requirements – which will likely have resulted in improving solvency ratios. This is supported by the sensitivities that insurers disclose within their annual solvency reporting, as shown below.

|