By Mark Hixon, Navigant Consulting By Mark Hixon, Navigant Consulting

Over the years, firms operating within the life and pensions sector have learnt to perform a balancing act between providing a high quality service and managing their costs. However, faced with ever-decreasing margins, tighter regulation and increased competition, modern financial services firms need to strive for more creative ways to do ‘more for less’ by dealing with service-related pressures while simultaneously lowering the cost of all their business functions.

For obvious reasons, many firms are left wondering how to achieve this balance, especially within a marketplace as dynamic and competitive as financial services. The answer lies in three key areas: cost allocation/modelling, cost management and process performance management.

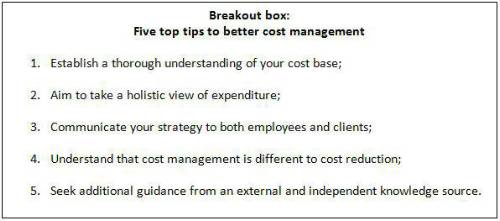

Before tackling any of these areas, however, the first step will be to determine the ‘size of the prize’ that strategic cost management initiatives will be able to deliver to the organisation. Providers can achieve this goal by performing a comprehensive operational review in order to identify any areas that can be improved. In particular, firms will need to carefully assess the costs associated with various elements of their value chain, including key areas like distribution, manufacturing, servicing and administering the product (and the associated investment or debt). It is also crucial that any such review encompasses the support functions required to support those activities on the core value chain. It is then essential to use cost allocation techniques to enable all of the support activities to be allocated to the core value chain thus enabling the full cost of delivering activities on the core value chain to be made visible.

By analysing the value chain in this way, firms will be able to take a much more ‘customer centric’ view of the business. For even greater granularity, firms can classify all of their business activities according to whether they are primary (on the value chain) or secondary (supporting the core value chain), or whether they are mandatory, discretionary, value-adding, non-value-adding or undertaken due to governance requirements.

At this stage, companies can then undertake a range of cost management approaches to augment this overview with an internal assessment. Within support areas they can undertaken reviews of internal service levels supported by root cause analysis whereas operational areas can employ ‘lean / six sigma’ techniques that will allow them to harness the operational expertise of their employees and understand, from their perspective, what they see as the main challenges that they are facing on a day-to-day basis. This type of review can be conducted through detailed analytical analysis and problem-solving techniques – the latter will include workshops with operational teams identifying areas in which the organisation can increase the quality of service and yet become more cost-efficient at the same time.

After these initial workshops, a detailed analysis of the findings will help to determine the viability of any initiatives raised, define the areas of service levels which need to improve, offset this with cost savings, and calculate any development costs. The output of this analysis should be an aggressive but realistic change plan that includes details of the operational improvements, cost reduction proposals, and levels of investment required, as well as the perceived risks involved.

This holistic view of a firm’s costs represents the ‘Holy Grail’ of effective cost management, as it allows the firm to see exactly how and where its funds are being used. With this approach, the operational workforce can also contribute to plans that will help to improve operations and reduce costs, and which work within the wider commercial strategy of the business. In addition, by actively contributing to the solution in this way, employees are more likely to achieve a greater sense of ownership.

Along with this internal review, it will also be important to seek additional guidance from an external and independent knowledge source, as this can provide an extension of the themes (via the use of qualitative and quantitative benchmarking) that emerge from the internally driven solutions and offer help in shaping solutions. By combining an internal and external review in this way, firms can inject a fresh perspective on their operations in order to determine where and how changes can be made.

This focus on process enhancement is another important way of reducing costs, since savings can also be achieved by understanding the different options that outsourcers, offshoring companies, or blended onshore/offshore solutions may be able to offer in order to improve service and reduce costs for the firm. As a result, firms are able to reduce costs within key processing areas by using a structured approach that delivers sustainable benefits and a new culture of managing continuous improvement.

However, in order to achieve this goal, firms will need to have a clear understanding of the ‘touch points’ between costs and customer service on one hand, and costs and commercial dynamics on the other, in order to pinpoint the strategic issues that they will need to tackle in order to manage their costs more effectively. For example, although improvements in one area may provide significant cost reductions, changes in another may unacceptably reduce the level of customer service. As such, every component within a company must understand what is trying to be achieved and both internal changes – as well as any external help received – must be incorporated in this vision.

Finally, and very importantly, once a strategy that supports both cost reduction and service improvements has been agreed upon (and the necessary process changes identified), communicating that strategy will be vital to the success of the project. After all, even if costs can be reduced in this way, firms still need to make this process sustainable for the long term.

For example, if morale is not to suffer, employees must understand why specific decisions have been made and where these fit into the overall strategy. Likewise, external audiences will be looking for confirmation that an organisation has made informed decisions on key topics rather than following recent trends or making knee-jerk reactions. Operations teams will therefore need to articulate a set of realistic and detailed objectives both internally and externally in order to ensure that the firm’s cost management goals are realised.

To save money in the short, medium and long term, it will be important to define these objectives very carefully, however, since cost management is a different philosophy to one-off cost reduction. After all, most firms aren’t trying to cut spending in every single area; they simply need to ensure that their funds are focussed on the areas that will have the highest impact on their clients, employees and ultimately the bottom line. As such, firms will need to take a more holistic view their expenditure, services and systems in order to achieve the desired results in these areas.

In today’s competitive, regulated, commoditised life and pensions market, businesses need to design their processes within predefined cost limits and ensure that they are executed in the most efficient way possible while maintaining the required levels of customer service. They also need to have a thorough understanding of the dynamics of their cost base and the ability to flex it in line with market conditions.

|