By Alex White, Head of ALM Research, Redington

For all the complexity of the issue, drawdown investors typically only have two levers they can pull. They can change strategy, or they can change how much they drawdown. All the analysis and projections we create are ultimately to drive those two decisions - beyond that, we are on the receiving end of reality.

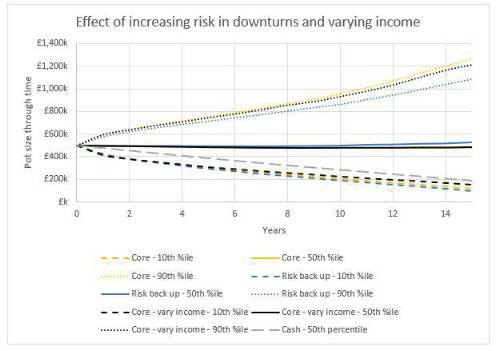

Varying income is not always possible, but where it is an option it can help mitigate tail risk- effectively, it’s reducing the size of the problem. In the chart below you can see, reasonably intuitively, that if you can afford to cut spending when investments underperform, you can reduce the uncertainty around your pot size. The example is marginal, as most investors will not have that much leeway to reduce drawdowns, but it can meaningfully reduce the probability of exhausting the pot and give it more chance to recover in the tails.

Moreover, by spending more when investments perform well, the expected overall income can be essentially unchanged.

Changing strategy can make a much larger difference than refining the withdrawals. As an extreme example to highlight this, I’ve included the central case for a 100% cash strategy on the same chart. Generally speaking, most strategy changes will either increase both risk and return, or decrease both. Visually, changing strategy tends to mean either increasing the central outcome and widening the cone of outcomes, or lowering and narrowing it.

However, there is a small refinement you can make by changing strategy dynamically, which has a different type of effect. Suppose you decide that, when investments do well, and you can afford larger drawdowns, you’ll make the investments a bit safer; and when you cannot afford the drawdowns as large, you’ll move to a higher return strategy and accept the extra risk. What happens?

In the positive tail, the strategy will tend to be de-risked, so you’ll lose some of the upside. In the negative tail, the strategy will tend to be risked up, so you’ll lose more at both extremes. In more typical scenarios though, where assets go up a bit and down a bit, you’ll tend to be positioned the right way round, de-risking after rises and before falls, and vice versa (this is actually survivorship bias as, if it turns out you were positioned the wrong way round, that means you were in a more extreme scenario). De-risking in downsides would have the opposite effect. So rather than trading off between higher expected returns and a narrower spread of outcomes, you can trade off between doing well in more extreme long-term scenarios or in more typical ones.

This is not a magic bullet, and it risks gaming any metric you use to measure the risk of possible strategies. However, adding this dynamism can be useful where investor preferences are not simple, or have binary cut-offs (for example, if the goal is to have enough to do something, then hitting it or missing it can make more difference than the size of any surplus or deficit). And modelling it allows investors to understand their options just a little bit more thoroughly.

|