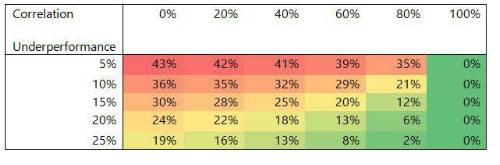

If your portfolio is diversified from the market, it means it will behave differently from the market. Fundamentally, that means there will be times where the market goes up and your diversifying assets go down. In fact, the more diversifying your assets, the more likely and more extreme this effect will be. The table below shows the probability of underperforming a lognormal asset with a mean return of 4% and a volatility of 20% with an identically distributed, correlated asset.

So, a diversifying asset will sometimes lose money when other assets are making money. In a way, this is exactly the property you want. But it can be difficult. In particular, diversifying assets are generally more complicated, and rely on less intuitive approaches to make money (such as alpha, or systematic risk premia). Psychologically, it can be extremely difficult to maintain confidence in a complicated and underperforming structure, especially if markets are generally up.

That has a cost.

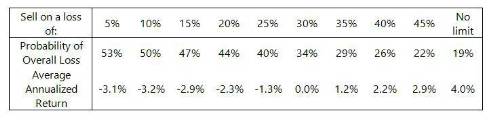

As an example, we can simulate 10,000 20-year periods of a lognormal asset with a 4% mean and 20% volatility, and mimic a sale of the asset in the event of a certain size loss over one year. In the 10% case, if the asset fell by 10% in year 6, it would be sold, and the returns would only be measured over those 6 years.

The lower your tolerance for holding an asset through a downturn, the more likely you are to lose money on it overall (assuming it has a positive expected return). In fact, if a 1-1.5 volatility move causes you to sell, you can expect a negative annualised return.

What’s going on? Effectively, the holding period is biased against you. You’re holding it for a period until there’s a loss - so there’s a good chance you’ll hold the asset for a short period that contains a large loss.

Now, some of this is optical - the mean return is constant, but the average annualised return depends on the period held - so the average of -5% pa for one year in one simulation and 5% pa for 20 years in another would be 0%. If we weighted the simulations by the time held, the average would be the underlying mean. However, if you bought an asset then sold it at a loss, you’re unlikely to take much consolation from the asset subsequently going up.

If you have a plethora of equally good portfolios available to you, and sell out into an equally good asset, this isn’t that big a problem - the drag will just be transaction costs. However, if you revert to a simpler, less diversified portfolio, then you are likely to be worse off for it.

What does this all mean? If you buy an asset without being especially convinced of it, or without fully understanding it, it’s likely to be harder to hold onto it through any losses. The less able you are to hold an asset through a difficult period, the more likely it is that you’ll lose money on it.

|