No allowance for poor health despite more than 30% cut in maximum income No allowance for poor health despite more than 30% cut in maximum income

-Now need over £140,000 to get same income as £100,000 fund in 2009

-Lower withdrawals to cost HMRC £100million a year in tax revenue

-

Government rule changes coupled with QE gilt-buying are double blow to income drawdown pensions as pensioners forbidden to spend their own money

-

Need over £140,000 now to get same income as would be paid by £100,000 drawdown fund in 2009

-

Pensioners in poor health particularly hard hit as no enhanced rates allowed for

-

Treasury should allow higher income if in poorer health as 100% GAD rule unfair

-

Middle class pensioners in capped income drawdown face >30% pension cut

-

Wealthiest unaffected as rules don't apply to flexible drawdown

-

Lower drawdown income means Treasury tax revenue may be £100million lower

Drawdown investors don't want to buy annuities but still hit by fall in annuity rates: Around 325,000 middle class pensioners have put nearly £20billion into Income Drawdown. These pension savers did not want to be locked into an annuity, which takes away any chance of capital growth, yet they now find they are being hit by falling annuity rates anyway.

Double whammy as maximum permitted withdrawal linked to falling annuity rates and Treasury reduced limits at same time: The Government Actuary's Department (GAD) sets the maximum amount people can take out of their drawdown fund each year, based on the income that would be paid by a standard annuity. This GAD rate is linked to changes in 15-year gilt yields, which have declined sharply following the Bank of England's Quantitative Easing, QE, policy and, on top of that, the Treasury cut the annual withdrawal limit from 120% of the GAD rate to just 100% in April 2011.

No allowance for ill-health: The effects are particularly harsh on those in worst health as no special provision is made within the Drawdown rules for their shorter life expectancy. In the annuity market, they would be able to get an enhanced or "impaired life" rate, but with Income Drawdown, the GAD rate only reflects income paid by a standard annuity, which is much less.

Wealthiest not affected: Government boasted of flexibility with its new annuity rules, but this is only for very wealthiest. The wealthiest pensioners can use flexible drawdown and take out as much money as they like, so they are unaffected. However, those who are less healthy and less wealthy are being hit hard.

Need £140,000 fund to get same drawdown income as £100,000 would allow three years ago: These cuts mean someone wanting the same income as they could have taken from a £100,000 pension fund in August 2009 would now need a fund of over £140,000.

These changes also mean lower tax revenue: As the income people can withdraw falls, they will pay less tax to HMRC. This will worsen the fiscal deficit in the short-term! If we assume that just £400million a year has been paid on the £20billion in drawdown, then a 30% fall in income withdrawn would imply a loss over £100million in tax revenue. And, not only are they paying less tax, they are also spending less money in the economy, so there is both a fiscal and economic impact.

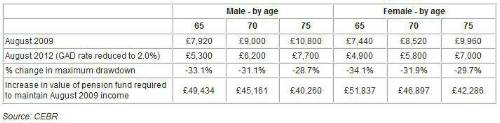

The Table shows the impact of these combined changes on a £100,000 pension fund in the past three years.

For example, the maximum annual income a 65-year-old man could draw from a £100,000 capped drawdown pension fund has fallen from £7920 in August 2009, to £5,300 last month and for a 65-year old woman has reduced from £7,440 to £4,900 last month.

Trust in pensions damaged as people denied their own money: Such problems have further undermined confidence and trust in pensions. People who have saved hard and expected their pension savings to support their retirement lifestyle are forbidden from spending their own money. Despite having become used to a particular level of pension for the past few years and still having plenty of money in their fund, the government will not allow them to get their hands on it.

Possible policy changes to consider:

Make allowances for poor health: It would seem only fair to ensure that people in poor health are not deprived so unfairly of the income in their pension funds. Allowances for health issues, akin to those that would result in higher annuity income being paid on grounds of poor health, could be made, so that people with lower than average life expectancy can withdraw higher than average income from their capped drawdown pension funds. This would also boost tax revenue immediately.

Revert to 120% of GAD rate: Increasing the maximum permitted withdrawals from income drawdown back from 100% of GAD rate to 120% would also bring in extra income tax revenue, much-needed in the current fiscal environment and better reflect the exceptional nature of today's very low yields!

Make allowances for temporarily low gilt yields: The latest OBR long-term projection for gilt yields assumes a normal level of yields will be 5% (more than double the current level). With gilt yields at record lows right now and the Bank of England having artificially distorted demand for gilts, there is a strong case for adjusting the GAD rate to take account of average past yields (perhaps average of the past 5 or 10 years), rather than using a point estimate at the current record low.

When people were allowed to withdraw up to 120% of the GAD rate, at least there was some extra allowance to help those in poor health. It is only fair that the Government rectifies this lack of provision for poor health and I do hope Ministers will urgently reconsider this issue.

|