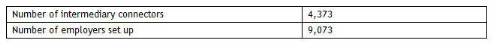

• Over a quarter of all NEST employers use intermediated service, with over 9,000 employer accounts added to NEST Connect in last 12 months

• 4,300 intermediaries became NEST Connectors in last year, an average of 350 each month

Launched a year ago today (12 November) the online portal has seen over 4,300 intermediaries sign-up to be a NEST Connector in the last 12 months, an average of over 350 each month. New data shows that of the 33,000 employers signed up with NEST, almost 9,000 of them (over a quarter) are being administered via NEST Connect. The online hub allows employers to delegate the administration of their NEST scheme to a third party such as an accountant, adviser or payroll bureau.

The success of NEST Connect confirms that employers are looking for intermediated solutions and the intermediary community are tuned in to the opportunity that technology, like NEST Connect and the recently launched NEST web services, presents.

Gavin Perera-Betts, executive director of product and marketing at NEST, says:

‘Employers and intermediaries are voting with their feet. Almost a quarter of all NEST employers have involved intermediaries through NEST Connect to help with auto enrolment, leaving them to focus on what they do best, running their business. Intermediaries also seem to be harnessing the opportunity that NEST Connect presents, using the technology to deliver their auto enrolment proposition. Data shows that this has really taken off in the last year. With 1.8 million employers yet to enrol their staff, intermediaries such as IFAs, accountants and payroll providers could be very busy during the next stage of auto enrolment.

‘Although managing auto enrolment in-house doesn’t have to be difficult, advances in technology, such as NEST Connect and NEST web services, mean that employers can choose what works for them and even hand over the whole project if they choose.’

Key facts about NEST services:

• NEST Connect is our online hub for professionals who are offering auto enrolment services to multiple employers. It’s an ideal solution for financial advisers, accountants and payroll providers. And it’s completely free to use.

• NEST web services will simplify the exchange of information between employers and NEST by enabling payroll software to ‘talk’ to NEST directly. That means employers will be able to manage NEST through their payroll software, meeting their day-to-day auto enrolment duties without needing to log into NEST separately.

Key facts about auto enrolment:

• Government workplace pension reforms mean most employers will have to automatically enrol workers into a workplace pension scheme that meets or exceeds certain standards. Employers will also need to make a minimum contribution for many of these workers.

• NEST, set up as part of the reforms, is a good quality defined contribution workplace pension scheme available to all employers to use to meet their new duties.

• NEST has a public service obligation to accept any employer (whatever their size) who wants to use the scheme to meet their duties.

• NEST is designed around the needs of people who are largely new to pension saving, with clear communications, low charges and easy online tools and services. It is run as a trust-based scheme and the Trustee has a legal duty to act in its members’ interests.

NEST Connect figures

|