By Stephen Wilcox, Chief Risk Officer, Pension Protection Fund

The Purple Book is absolutely crucial to us at the PPF, particularly with regards to our risk management strategy. Using its data, we can survey key themes within the DB universe including scheme demographics, funding levels and asset allocation and create a picture of the environment which subsequently informs our view of the risks that face us, our members, and the 10.5 million members of the schemes we protect.

Scheme Demographics

The shift in scheme demographics over the last year is a key indicator of the state of the DB universe. In this year’s Purple Book, the proportion of schemes open to new members remained stable at 12 per cent – but because schemes continue to close or merge the number of schemes still open continues to fall. The report also showed that schemes continue to close, rising from 39 per cent in 2017 to 41 per cent. However, despite this trend, 1.3 million people continue to accrue new benefits in their DB schemes.

Funding Levels

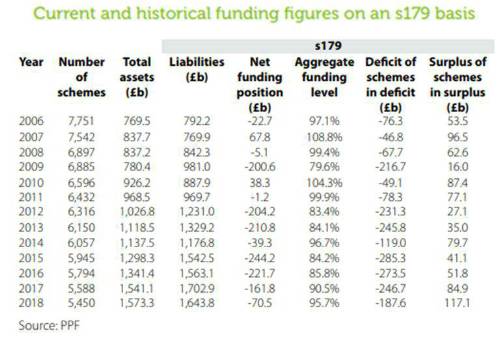

Perhaps the Purple Book’s most important and headline-grabbing feature is the insight it provides into the changing funding level of the DB universe. This year, the aggregate funding level published in the Purple Book has increased to 95.7 per cent, on an s179 basis. This is a 5.2 per cent increase since 2017. A s179 valuation is the estimated cost to a scheme when buying benefits equivalent to those the PPF would provide from an insurance company.

This increase is partly due to more up-to-date valuations, a shrinking universe and market movements - higher gilt yields have been driving down liability values and a rise in equity markets has also helped to increase asset values.

While the aggregate funding level has improved and continues to improve under the new s179 assumptions, more than 3,000 of the 5,450 schemes in the DB universe remain in deficit as reflected in the recent PPF 7800 index published on 11 December 2018. These schemes have a combined deficit of £137.6bn and highlights the significant risk that the universe poses on the PPF.

Risk Reduction

The Purple Book also provides key insight into the ways DB schemes have reduced their risk. This year, DB pension schemes have continued to close to new benefit accrual, and in terms of asset-side risk reduction, they have also continued to move their investment allocation away from equities and towards bonds.

Scheme sponsors have also been making Deficit-Reduction Contributions. Data from the Office for National Statistics covering around 360 large pension schemes, for example, shows that in the year to 31 March 2018, sponsoring employers made £13.5 billion in special contributions, compared with £12.2 billion in the year to 31 March 2017.

The value of risk transfer deals (buy-outs, buy-ins, longevity swaps) in the year to 30 June 2018 also continued to improve according to data from Hymans Robertson, rising to £22 billion, up from £16 billion the year before, with large deals in H2 2018 so far including BA (£4b) and Nortel (£2b).

Interestingly, the data also suggests that DB pension transfers are at their highest since the introduction of Pensions Freedoms in April 2015, amounting to £10.6bn in Q1 2018.

However, these figures remain relatively small in the context of the DB pension landscape. The schemes we protect have assets totaling around £1.6 trillion – and there are other large schemes outside of our universe.

PPF Funding

While the Purple Book focuses on the universe of DB pension schemes, it is also important to position the data alongside the PFF’s own funding levels. Whilst the external environment and universe of schemes we protect continues to present challenges, we have continued to make steady progress towards our strategic objective to be self-sufficient by 2030, and our financial position remains robust. We believe our funding position and investment strategy has put us in a good position to confront future challenges and we stand ready to protect schemes.

Nevertheless, we will never be complacent about the risks we face. We will continue to publish the Purple Book and use its data so we can have a deep understanding the DB universe we protect and the risks it poses on us. The Purple Book plays a vital role in our capability to model long-term risks so we can meet current and future business needs and support our funding strategy.

Finally, the PPF continues to pursue our mission within a high calibre framework of risk management, protecting millions of pension scheme members today and for as long as we are needed in the future.

The PPF’s Purple Book 2018

|