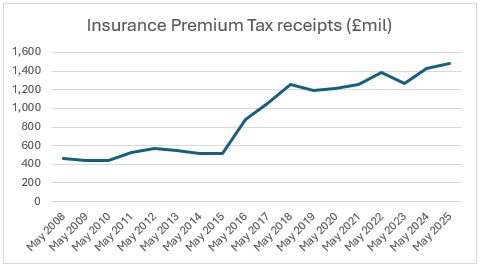

The last financial year delivered record IPT revenues of £8.88 billion and the latest OBR forecasts on IHT made at the Spring Statement estimate that the tax would raise £9.2 billion for the Treasury in 2025/26, with this figure rising to £9.9 billion by the end of the decade.

It follows analysis of the latest FCA Financial Lives Survey 2024 which found that 14% of UK adults now hold PMI, a total of 7.6 million people which has increased from 6.7 million in 2020.

Healthcare cash plans and dental plans have also seen a significant rise in demand over the past four years increasing from 4.0 million plan holders in 2020 to 5.1 million in 2024 according to the statistics, highlighting similarly high demand for other health insurance products

Cara Spinks, Head of Life & Health at Broadstone, commented: “IPT receipts in May reached a record £1.48 billion, maintaining the elevated levels seen in April and suggests another strong year of revenue for the Treasury might be on the cards. Ongoing challenges in NHS accessibility and waiting times continue to drive interest in independent health insurance options, such as PMI and health cash plans. Many employers are expanding health coverage to support employee wellbeing and manage the impact of sickness-related absences.

“This trend is contributing significantly to the growth in insurance premiums, alongside an increase in both the frequency and cost of claims, particularly as more complex and previously untreated conditions are addressed. However, rising premiums are making these health insurance products less accessible for some, despite their clear preventative and productivity-related benefits. We encourage the Government to consider reducing or removing the tax burden on these products to support broader access and promote a healthier, more resilient workforce.”

|