|

|

The initial results of the 2023 valuation for the Independent Schools’ Pension Scheme (ISPS) reveal a significant deterioration in funding level, which could lead to Deficit Reduction Contributions (DRCs) tripling as a result. The ISPS Employer Committee (EC) recently wrote to all participating School’s to highlight the initial results of 30 September 2023 actuarial valuation. |

By Adam Poulson, FIA, Partner at Barnett Waddingham In this blog, we’ll highlight the key messages from this communication, and use it to frame why, given the large increase proposed, we are recommending participating schools to seek independent advice on the matter. Key takeaways

Our key observations from the communication are:

Deficit contributions could increase threefold: Each school will actually see a slightly different increase depending on their underlying membership, but the expectation is that most schools will likely see a significant increase to their contributions.

The deterioration is primarily due to the investment strategy adopted: The EC have cited that the fall in funding level is primarily due to the investment strategy adopted by the Trustee in recent years. ISPS uses Liability Driven Investment (LDI) to help stabilise the funding position, but these asset classes experienced difficulties in September 2022 when government bond yields rose significantly. ISPS also holds growth assets to target higher returns, but these too have underperformed over the past few years. Further information can be found in the EC’s March 2024 update.

The proposed recovery plan structure remains unchanged: The current and proposed recovery plan both increased 3% p.a. and are set to end in June 2032 – the EC will negotiate the payment amount and structure of the recovery plan, and potentially could ask to extend the recovery plan length to reduce the annual payments. Depending on a school’s financial position, there will likely be differing views on the pace of contributions within ISPS.

The EC are continuing to liaise with the Trustee regarding the results of the valuation: There may be scope to negotiate the assumptions used within the calculations to alter the deficit (albeit it’s unlikely they will reduce the deficit by a third). The EC have asked for schools to provide affordability information to help them work with the Trustee regarding the proposal for deficit contributions. We understand the Trustee is very open to assessing a school's affordability, so it is therefore in the interest of schools to submit this information as accurately as possible.

Valuation results

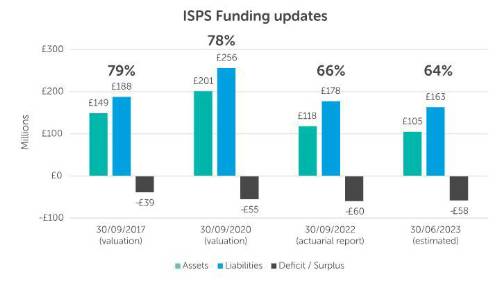

The results of the recent funding valuations and updates are shown below.

Since 2017, ISPS’s funding position has deteriorated, and an increase in deficit reduction contributions is now required. The increase in contributions compared to the rates set in 2020 is a result of the deteriorated funding level, as well as being three years closer to the proposed recovery plan end date in 2032. In addition, the 2020 valuation allowed for post valuation experience when calculating the recovery plan – the £2.7m contributions were calculated to repair a deficit of around £37m rather than £55m.

DRC and expense payments

The proposed increase to DRCs is the latest challenge to face schools who are already under financial pressures. The recovery plan was extended by two years as a result of the 2020 valuation, and if no changes are made to the current recovery plan end date, the average school would see a threefold increase in their DRC payments.

The EC’s communication did not mention how the 2023 valuation results impact expenses. However, as expenses are not directly linked to the funding of ISPS, it is not expected there will be will an increase as significantly as the DRCs.

Debt on withdrawal position Although the calculation of deficit reduction contributions and exit debts are separate, it is often the case that they will move in the same direction as each other. An increase to deficit reduction contributions likely means debts will have increased too.

Options available

Some options available to schools may involve:

Withdrawing from ISPS and paying the exit debt – this however may come at a material cost (including expenses). However, the ongoing legal case with TPT, regarding how members benefits have been determined in practice, is also stopping schools from exiting and being given the necessary legal discharge of their liabilities to ISPS.

Considering member option exercises – offering member option exercises (such as commutation exercises, pension increase exchange exercises and transfer value exercises) could be an effective way to reduce exit debts.

Transfer options – there might be other options available to you to if you currently cannot afford to pay your full exit debt. For example, you might be able to meet the costs of establishing a new scheme and transferring your ISPS assets and liabilities into it. In this a case a payment would still be required to ISPS, but it would likely be much lower than your exit debt.

You may also be interested in our Growth Plan blog, which considered how employers could proactively manage their participation in the Growth Plan and some of these considerations also apply here.

Other TPT Schemes Many of TPT’s multi-employer DB arrangements are currently undertaking actuarial valuations at 30 September 2023, including some of the larger schemes such as the:

Growth Plan (GP) As each scheme has a different investment strategy in place, a funding level deterioration to the same extent as ISPS is not guaranteed. However, as the schemes are governed by the same trustees and advisers, some deterioration in funding level (and therefore increase to DRCs) would not be surprising. |

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.