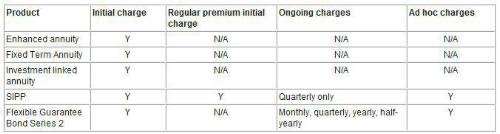

Retirement specialist LV= today confirms that its retirement products and systems are RDR ready, and the different charging methods that will be implemented from 31 December 2012 (table below), are as follows:

How LV= will implement adviser charging post 31 December 2012

Pipeline and commission:

SIPP, annuity and Flexible Guarantee Bond quotes can be requested up until and including 30 December 2012 on a pre RDR commission basis. If a re-quote is requested or the application is then received by LV= after this date, as long as the original quote is dated before 31 December 2012 it can be processed on commission terms, provided no further related advice has been given. Flexible Guarantee Bond applications must be completed before 9 February 2013, and SIPP and annuity applications before 6 April 2013, otherwise they will need to be charged on a post RDR basis.

Quotes for LV='s SIPP, annuities or Flexible Guarantee Bond requested on or after 31 December will automatically be on a post RDR charging basis.

LV= has a dedicated RDR section on its website for advisers www.LV.com/rdr. The pages include information on what the RDR changes mean, the practical issues arising from them, how LV= is implementing adviser charging from 31 December 2012 and related deadlines. It also includes a series of sales aids designed to help advisers position their offering and services post-RDR.

Phil Brown, LV= Head of Retirement Proposition, said: "The implementation of RDR means that many advisers are having to remodel their businesses. We hope that by announcing our RDR proposition well ahead of the December deadline, we are providing advisers with much needed clarity and certainty as to how we will facilitate adviser charging."

"We are keen to support advisers through this change and alongside our dedicated RDR web pages that will be regularly updated as the deadline approaches; we will soon be announcing an RDR webinar for advisers."

LV='s Flexible Guarantee Bond, enhanced annuity and investment linked annuity will continue to support commission on intermediated non-advised business once RDR comes into force.

|