By Stephen Makin, Head of Risk and Capital Management, Life & Financial Services, Hymans Robertson, Lynn Yorkston, Consulting Actuary, Fyona Allan, Consulting Actuary

So, with the first round of Solvency II reporting complete, now is a good time to consider options for managing your balance sheet volatility. This article talks about managing this volatility for unit-linked business.

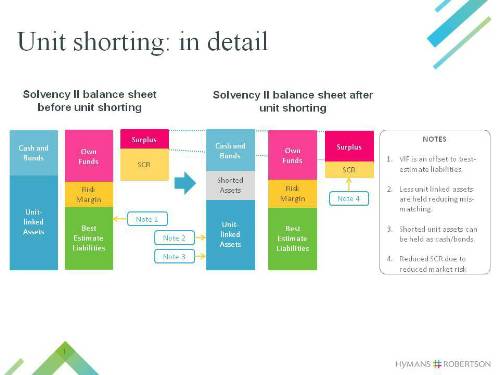

The approach taken by life insurers writing unit-linked business under Solvency I was to fully match unit-linked liabilities with unit fund assets. This is not strictly necessary under Solvency II: insurers need only recognise the best-estimate value of unit-linked liabilities rather than the full value of the policyholders units, with the difference being the VIF. Fully matching unit fund assets to policyholder values can therefore lead to a volatility in Solvency II Own Funds which is larger than is in some senses necessary.

There are a number of ways in which insurers could look to mitigate this, including hedging and VIF monetisation. Another way is “unit shorting” which has at its heart holding less in unit fund units than the face value of policyholder units. The relative attractiveness of unit shorting compared to other options will depend on insurers’ specific circumstances, but what unit shorting does is allows companies to make a choice over asset allocation and the level of Own Funds volatility they are happy to withstand.

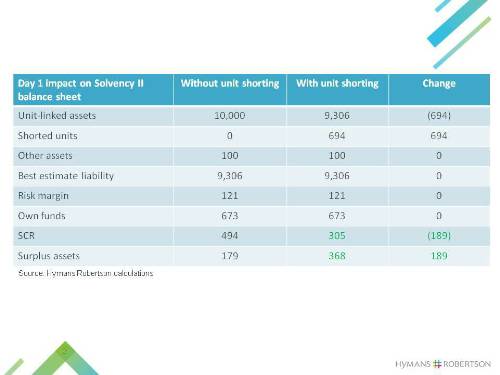

The table below shows parts of the balance sheet of a hypothetical unit-linked insurer and how they are affected by unit shorting. We have illustrated the effect by assuming that assets representing the entirety of the VIF are shorted.

As can be seen, unit shorting leads to a reduction in the Solvency Capital Requirement (“SCR”) from reduced levels of market risk exposure.

To help demonstrate the benefits of unit shorting on the stability of the balance sheet to market volatility, we show below the change in both Own Funds and surplus assets if markets (and therefore unit prices) fall by 20%. As can be seen, unit shorting can lead to a situation where Own Funds are largely unaffected as prices fall, while surplus assets can increase.

Unit shorting therefore has several potential benefits:

it can reduce the volatility of Own Funds on the regulatory balance sheet

the “shorted” assets can be used elsewhere in the business or to help manage overall liquidity

the SCR reduces due to a smaller market risk exposure which results in increased surplus assets

These benefits need to be assessed against the practical considerations of implementing and operating such a policy. For example, the value of the liabilities changes on a daily basis. The balance sheet therefore needs to be monitored and investments rebalanced frequently to ensure the unit-linked technical provisions remain closely matched by unit-linked assets. For practical purposes, it would be usual to only short a proportion of the possible units in order to strike a reasonable balance between stabilising Own Funds and frequent rebalancing.

Before deciding if unit shorting is the right thing for you we advocate carrying out a short, focused feasibility study to allow you to understand the costs, benefits and operational requirements. Areas to consider include:

impacts on other reporting measures, e.g. IFRS profits

the need for enhanced reporting and MI capabilities

liquidity planning

the need to ensure that customers are treated fairly (no detriment)

regulatory interactions

any tax consequences

What to do with the cash?

Firms that decide to implement unit shorting will find themselves with increased liquidity. However, given the current low interest rate environment it’s unlikely to be desirable to have large amounts of excess cash earning low returns. In order to find a suitable investment strategy for these assets firms can begin by determining the universe of potential investments and then carry out an efficient frontier analysis both to evaluate suitable portfolios and to identify what needs to be done to get there.

As always, there are a number of important considerations as part of this analysis, including:

the ability and expertise needed to manage and value the assets

the ability to generate yield

the impact on the SCR

the impact on liquidity

exposures that shareholders already have compared to their expectations

This article originally appeared in Hymans Robertson’s quarterly publication ‘Current Issues in Insurance’ the full edition can be viewed here

|