By Patrick Hayward, Consultant at Altus Consulting

The introduction of the Civil Liability Act 2018, which is expected to come into force in April next year, should be seen as a welcome development from an industry, consumer and broader societal perspective. Ultimately, all motorists are currently paying for such claims through their premiums, and there is a widespread view that it is all too easy to pursue a claim for about £2,000, for an injury which is in many ways hard to prove (but harder to disprove).

The forthcoming legal reforms will have a significant effect on the shape of third-party claims received by insurers, in terms of levels of damages, the types of representation and the method, with a new litigant in-person portal currently in development.

A new legal environment

The headline change under the CLA is the reduction in general damages that claimants will be able to recover. Combining this with the anticipated increase in the Small Claims Track limit, which is due to take place at the same time as the CLA comes into force, there will be a significant effect on the overall costs to compensators on a per claim basis.

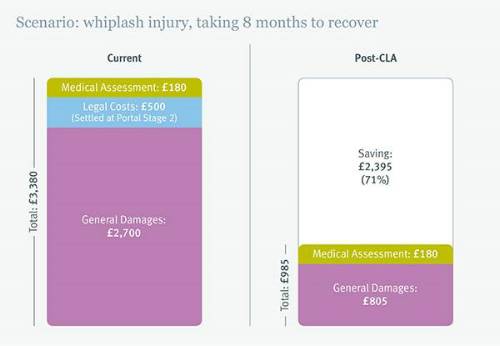

As an example, a whiplash injury that is expected to last for 8 months would currently attract damages of about £2,700. Factoring in legal costs for a claim that settles at Stage 2 of the Claims Portal process (£500) and the medical assessment cost (£180), insurers pay on average about £3,380. With legal costs unrecoverable by claimants in the Small Claims Court, and damages fixed under the CLA at £805 for the prognosis period, the insurer would save £2,395 (71%) on this claim.

Image from Whiplash: Looking beyond the costs

The introduction of the new damages tariff will therefore have an immediate, tangible benefit to insurers. It does not, however, appear likely that claims volumes will significantly diminish, as consolidation of claimant law firms and claims management companies (CMCs) is expected to mean that they can continue to profit from this work, albeit with much tighter margins. Adoption of process automation for simpler tasks should mean that paralegals handling claims will be expected to manage a larger caseload, and CMCs could well start acting for claimants under damages based agreements (DBAs), whereby claimants pay a cut of the compensation they are awarded to their representative.

For insurers, this will broadly mean a simplified process for handling the assessment of claims, but potentially without the reduction in frequency originally targeted by the reforms, and a shake-up on the claimant side which could mean dealing with different types of representatives, and much greater proportion of claimants acting for themselves.

The reduction in exposure to claim costs may lead to a reduced focus on this area, but there is a real need to ensure that any changes in approach by insurers are implemented with sufficient controls to be able to identify and react to emerging behaviours and trends. Otherwise, they will find themselves the target of new types of fraud, and may see costs increase repairs, credit hire and other injuries outside the definition of ‘whiplash’.

What next for insurers?

Now that the shape of legal change is nearly finalised, motor insurers should be starting to develop plans for a future operating model, with processes aligned to the new damages tariff, which removes the need for a detailed legal assessment of injuries, managing claims through the Litigant-in-Person Portal, and which incorporates AI capabilities which have been developing in the claims space over the last couple of years.

A note of caution – with the shift towards automation and self-service by insureds and third-party claimants alike, there is scope for different kinds of abuse of the system, and emerging fraudulent behaviours that have not yet been considered. It is therefore vital that insurers continue to adapt their counter fraud models, and the tools in their repertoire, to respond to the threat posed by opportunists, organised fraudsters, and the potential enablers in the form of less scrupulous law firms, CMCs a variety of other ancillary parties involved in the claims process.

For further information, see the latest GI whitepaper from Altus, Whiplash: Looking beyond the costs.

|