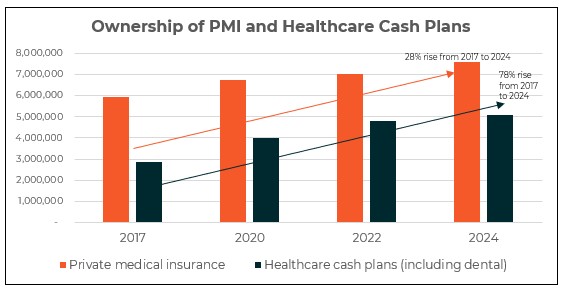

Analysis by Broadstone of the latest Financial Lives Survey from the Financial Conduct Authority uncovers the rapid growth in the take up of health insurance products following the surge in NHS waiting lists.

The data shows that 14% of the UK adult population now hold Private Medical Insurance (PMI), a total of 7.6 million people which has increased from 6.7 million in 2020. Health insurance is most popular among those in the middle of their career with 18% (1.7 million adults) of those aged 35-44 and 19% (1.6 million adults) of those aged 45-54 holding a PMI product. Healthcare cash plans, including dental, have also seen a significant rise in demand over the past four years increasing from 4.0 million plan holders in 2020 to 5.1 million in 2024 according to the statistics.

These products were also some of the most likely insurance plans for policyholders to make claims, with 50% of healthcare cash plan holders and a third (32%) of PMI plan holders making a claim in the last two years. This tallies with Private Healthcare Information Network’s data showing private health admissions are at their highest ever levels.

The latest NHS England data3 shows that waiting lists hit 7.42 million in March 2025, an increase of over 3 million people compared to the backlog of 4.24 million people in March 2020 just before the pandemic struck.

Brett Hill, Head of Health & Protection at leading independent consultancy Broadstone: “There has been a marked increase in the number of people taking up health insurance products like PMI and healthcare cash plans, which correlates with the surge in NHS waiting lists. Employers recognise that the nation’s health service is struggling to meet demand and guarantee the health of workers so they are increasingly stepping in to offer benefit packages that can support the health and wellbeing of their staff. Given we are unlikely to see drastic improvements in NHS waiting times in the short-term and economic inactivity due to chronic inactivity remains a significant challenge for businesses, we would expect to see these trends continue. This will lead to further take up of health insurance, more claims travelling through to insurers and greater demand for private health services. While these trends create some short-term pressures in terms of premiums and capacity, they represent a significant shift in the public’s attitude towards the provision of healthcare, and therefore a huge opportunity for our industry.”

|