Speculation surrounding the fate of pensions tax-free cash ahead of Rachel Reeves’ inaugural Budget last October and plans to subject unused pension funds to inheritance tax (IHT) from April 2027 may have influenced the increase in people accessing their pensions

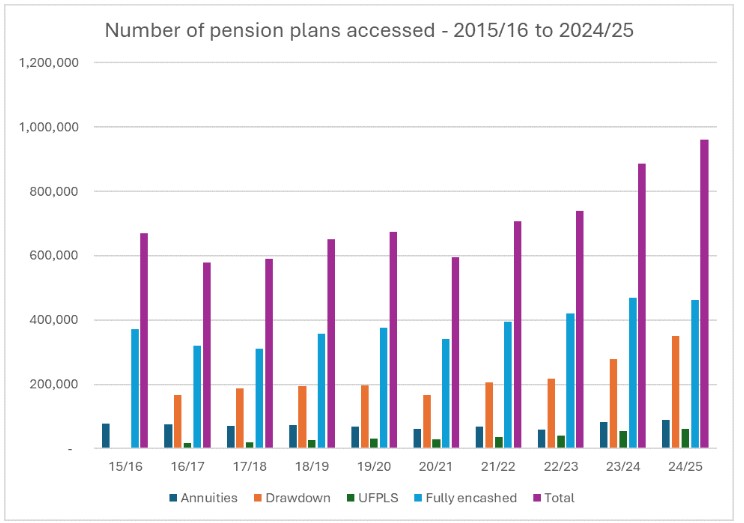

Drawdown continues to be the most popular retirement income solution, with sales of drawdown policies increasing by around 26% in 2024/25, up to almost 350,000

Sales of annuities also increased by 7.8% to 88,430 in 2024/25, partly fuelled by rising interest rates in recent years – but the rate of annuity sales slowed compared with 2023/24

AJ Bell analysis shows that 60% of people entering drawdown chose to take their cash but no income in 2024/25

Anyone entering drawdown should focus on their long-term retirement goals and consider carefully the sustainability of their withdrawal plan

Rachel Vahey, head of public policy at AJ Bell, comments: “There was a surge in the amount of pension money accessed in the 2024/25 tax year as it surpassed £70 billion for the first time, a 36% increase on last year, according to new data from the FCA. But the concern is people aren’t making decisions based on what’s best for them but because they are worried about possible changes to pensions tax incentives from the government.

“Speculation surrounding the fate of pensions tax-free cash ahead of Chancellor Rachel Reeves’ inaugural Budget last October led to an increase in people accessing their cash out of fear they may lose some of it to a change in policy, potentially causing untold damage to their long-term retirement plans. Alongside this, the announcement that unused pensions would be subject to IHT from April 2027 has led many to review their overall estate planning, possibly withdrawing pension money to spend or gift to loved ones.

“This neatly demonstrates the damage that idle Budget speculation can cause, driving people to make knee-jerk reactions about their personal finances. Brits saving for retirement need more stability that this. Creating the right environment for long-term planning means removing the worry that goalposts could shift at any given moment.

“That is why we are calling on the chancellor to commit to a Pensions Tax Lock, pledging not to make any changes to pensions tax incentives for the remainder of this Parliament.”

Appeal of drawdown continues to shine through

“The number of people choosing drawdown increased by a staggering 26% last year, perhaps reflecting that more wanted to bank their tax-free cash under the current rules before any possible tax regime changes were introduced. This is borne out by 60% of people entering drawdown choosing to take their cash but no drawdown withdrawals, suggesting most had no immediate need for an income. Equally, many could also be looking for the flexibility to take the right amount of money to suit their needs, finding drawdown the perfect balance between access and investment.

“In contrast, the proportion of those choosing to fully cash in their pension savings fell slightly from 53% in 2023/24 to 48% this year. And after a big increase last year, annuity sales appear to have settled down, seeing a more modest increase of just under 8% on the previous year.

“It is crucial anyone entering drawdown has a clear plan for making their pension last, which means you need to regularly review your retirement strategy and withdrawals to make sure they remain sustainable. If you aren’t sure how to go about this, it’s worth considering employing a regulated financial adviser to help you navigate what can be complex choices.

“For those who don’t want to take any investment risk or engage with their pension in retirement, annuities might be a more suitable option – higher interest rates have contributed to a surge in annuities purchased in recent years. Once you lock into an annuity, there is no going back, making it critical that you shop around the market not just for the best rate, but for the product that is most appropriate to your circumstances before buying an annuity.

“It is also important to remember that you can mix-and-match annuities and drawdown to suit your needs. For example, you could choose to purchase an annuity to cover your fixed costs, retaining flexibility and the possibility of enjoying long-term growth with the rest of your pot. Equally, you could opt for drawdown in the early years of retirement, then convert your pot into an annuity later on, when you should get a better rate. The key is to focus on your long-term retirement goals and take an approach aligned to those goals.”

FCA retirement Income Market Data

|