By Sue Vivian, Actuary By Sue Vivian, Actuary

Goverment Actuary's Department

Derisking has been high on the agenda for DB pension schemes for some time; usually employer led as risk reduction is not a "free lunch". There is a large and growing market of providers of risk reduction products, not to mention the less formal derisking strategies designed by investment consultants for individual schemes.

Rising equity markets have prompted a flurry of marketing from derisking specialists, after something of a lull in activity. But are current market conditions right for further derisking activity? Higher equity prices are only helpful if the marginal value has increased over the derisked alternative. Arguably the price differential has only moved to more typical levels but given the position of many schemes that may be all that is needed to revive derisking activity.

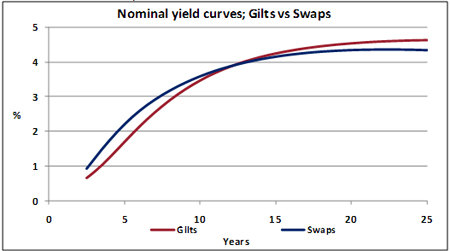

Most existing liability driven investment (LDI) strategies are built around swaps: interest rate, inflation and, more recently, longevity swaps. With gilt yields now more attractive than swap yields (see graph) will this lead to more gilt driven strategies? Swap based strategies allow much wider freedom in how the underlying assets are invested - with a greater or lesser amount of retained risk. The retained risk may offer a reasonable trade off for higher return expectations for many schemes, particularly where the sponsor has little interest or ability to offer additional funding in the short term but has reasonable longer term prospects.

Gilt based strategies are likely to be of most interest currently for those schemes where the sponsor has its eye on the end game and is seeking the opportunity to lock in at an affordable price. Affordable will mean different things to different schemes. And the most opportune time will only be identified with hindsight.

What about inflation hedging? Inflation swaps were relatively cheap last summer. With increasing inflationary expectations that window of opportunity appears to have been closed for the moment. How does CPI indexation fit into the equation? Many schemes will be moving to CPI as the basis for future pension increases. The swaps market remains RPI linked for the moment. A CPI market will inevitably develop but it will at least initially be expensive until volumes grow. RPI based protection will remain the only viable option for the foreseeable future. The underlying investment exposure many schemes carry in conjunction with inflation swaps is often underestimated and the risk reduction achieved may be less than trustees and sponsors perceive.

After a long incubation period the first longevity swap deal was signed off in 2009. A number of other high profile deals followed close behind but arguably there has been rather less subsequent activity than might have been anticipated - particularly when considered against the volume of investment swaps held by pension schemes. The complexity of such deals may have put some off, the upfront expenses mean only larger schemes can even consider such a deal. But fundamentally do longevity swaps offer reasonable value? Arguably the current market is cheap - if it is accepted that "cheap" means paying a rate broadly in line with what most actuaries would consider a prudent reserve value. This is because of competition between a number of willing counterparties who are each seeking opportunities to increase historically low yields from longevity profit.

Does derisking activity help or hinder a subsequent buy-in or buy-out? Conventional wisdom is that LDI strategies form a sensible step towards such an end goal. Whilst it is true many insurers will accept transfers of gilts the transferability, and benefit, of swap positions is less straightforward. The transferability of longevity swaps is wholly untested and terms could serve to limit a scheme's options in further derisking exercises. Before signing up to such deals schemes should ensure they are well advised on exit and other options.

Chart 1: At longer maturities gilt yields are higher than swaps, making gilt based hedging strategies cheaper.

Source: Bank of England

(The swap curves are derived using LIBOR-based interest rate swaps and other instruments linked to LIBOR including short sterling futures and forward rate agreements)

|

By Sue Vivian, Actuary

By Sue Vivian, Actuary