Meanwhile, PwC’s Buyout Index also recorded a surplus position of £90bn, demonstrating that DB pensions schemes continue to have, on average, sufficient assets to ‘buyout’ their pension promises. Similar measures to these Indices, or percentages of them, may be used to determine when pension schemes are sufficiently well funded to release “trapped” surplus under the Government’s plans to make accessing surpluses easier for UK defined benefit schemes.

Gareth Henty, PwC UK Head of Pensions, said: “Allowing DB schemes with surplus assets to deploy funds beyond their immediate obligations could certainly provide a level of the required investment for infrastructure, innovation, and broader economic growth. A potential surplus of £180bn is a figure that can’t be ignored by Government.

“But, if Government proposals are to work, as well as addressing whether pension schemes’ trustees have the power to pay surplus assets to employers, they will need to tackle the more fundamental issues of why trustees should do that. In particular, the proposals will need to think about how to address trustees’ concerns that a strong funding position today could become a weak funding position tomorrow, also in the context of the long term employer covenant supporting the scheme.

“The fine print matters - so we will have to wait for more details in the Government’s response to the consultation on Options for Defined Benefit schemes in the Spring. It will be interesting to see whether the Government can offer any meaningful incentives or underpins to support sponsors and trustees in pursuing a path of run-on with surplus sharing versus securing benefits with an insurance company. If they can, we then have the questions of whether corporate sponsors will have more of a say over investment strategy and risk management in future.”

Sam Seadon, Head of Investment Strategy at PwC, added: “There has been something of a roller coaster ride experienced by our clients in bond and equity markets in recent months. In light of these moves, we are seeing pension clients checking their funding positions, and reassessing or clarifying their long-term strategies.

“UK credit spreads are also now very low, and some clients are re-evaluating allocations to traditional corporate bonds in favour of shorter-term credit assets. This also appears to be having an impact on the way that transactions for pension schemes looking to transfer to an insurance company are priced - in the past this has often followed the prices of corporate bonds, but during 2024 this relationship broke down. Although this meant that buyout pricing still remained generally good in 2024, we’ll have to see what the implications of this are and how pricing may change if spreads remain so low.”

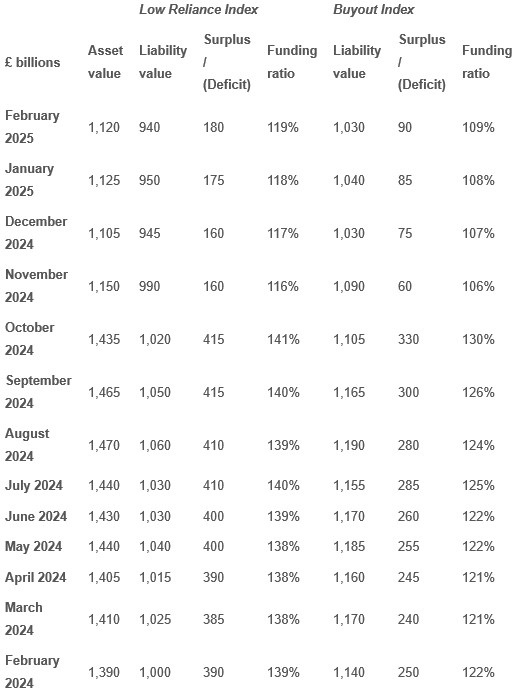

The PwC Low Reliance Index and PwC Buyout Index figures are as follows:

|