The MPC should develop and pre-announce a medium term strategy for returning official bank rate to a more normal level of around 2-3% by mid-2015.

UK economy broadly flat in 2012, but recovering to 1.8% growth in 2013 as consumer spending, investment and net exports pick up.

While current economic conditions do not support an immediate rise in interest rates, the Bank of England’s Monetary Policy Committee (MPC) should not add to QE at its meeting this week. The MPC should also develop and pre-announce a medium term strategy for returning Bank base rate gradually to a more sustainable level (2-3%) within a stated time frame (by mid 2015), according to analysis by PwC in its latest UK Economic Outlook report.

UK monetary policy is likely to remain very loose in the short term, but an article in the report by former MPC member and now senior economic adviser at PwC, Andrew Sentance argues there are risks in continuing this policy setting for too long as exceptionally low interest rates can distort the economy, and ultimately might undermine the inflation-fighting credibility of the MPC.

Setting a medium term interest rate strategy in advance would enable businesses to plan ahead as appropriate for the consequent rise in both short and long term interest rates, without derailing the economy in the short term.

Andrew Sentance, senior economic adviser, PwC, said:

"Dramatic cuts in interest rates and injections of money through QE played a key role in stabilising the UK economy in 2009 and helping bring about a return to growth. But these emergency conditions have passed and further injections of QE are having little beneficial impact. Indeed, persistent very low interest rates risk creating distortions in the economy and prolonging a period of persistent above target inflation.

"In the present 'new normal' economy, there may be no ideal time to raise interest rates. The MPC should therefore consider a gradual increase in the official Bank Rate to 2-3% over the next 2-3 years to return monetary policy settings to a more appropriate level. By setting out its strategy in advance, the MPC would help businesses and consumers plan for higher borrowing costs. And it would still be possible to move away from this path if the economy faced unexpected shocks.

"Putting in place an exit strategy to gradually raise interest rates and unwind QE is one of the big challenges facing the next Governor of the Bank of England."

UK economic outlook – PwC expects growth to pick up more than consensus forecast

The report projects GDP growth of around zero in 2012 as a whole, rising to 1.8% in 2013. Consumer spending growth of around 0.7% in 2012 and 1.3% in 2013 is expected as inflation has fallen back, easing the squeeze on real disposable incomes that led to a 1.1% fall in real consumer spending in 2011. The report also projects a gradual rise in business investment in response to stronger consumer demand and some improvement in global growth during 2013 that should boost UK net exports.

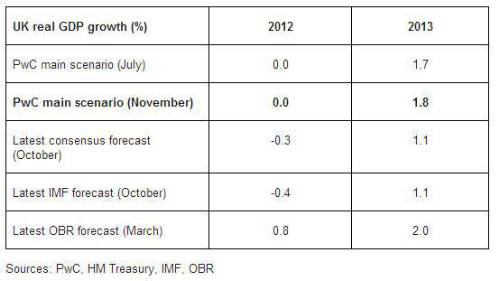

As illustrated in the table below, PwC’s latest UK growth projection is little changed from that in July but is somewhat more optimistic than the latest consensus and IMF forecasts, which have been cut significantly in recent months but now appear too pessimistic in the light of recent better news on GDP, the labour market, inflation and retail sales. The PwC projection for 2013 is not far below the official OBR projection made in March, although the gap is larger for 2012 given subsequent data.

John Hawksworth, chief economist at PwC, said:

“We have stuck to our guns since July in our stance on UK GDP growth while other forecasters have tended to revise down their outlooks. We believe that our views are justified in the light of the latest figures that showed a healthy rebound to GDP growth of 1% in the third quarter, together with other recent positive news from the labour market, inflation and retail sales.

“Overall, we see GDP being broadly flat in 2012 but picking up in 2013 to 1.8%. Growth rates vary by region but should be positive next year in all cases, supported by recent rises in employment in most regions. However, risks from further storms in the eurozone need to be taken into consideration and businesses should make appropriate contingency plans for this.

“Recent good news should also give the Chancellor a little more room for manoeuvre in his Autumn Statement on 5th December. We believe that he should focus his firepower on measures to boost infrastructure investment in areas like road maintenance that can come on stream quickly to support the struggling construction sector, while also strengthening the supply side capacity of the economy in the longer term.”

|