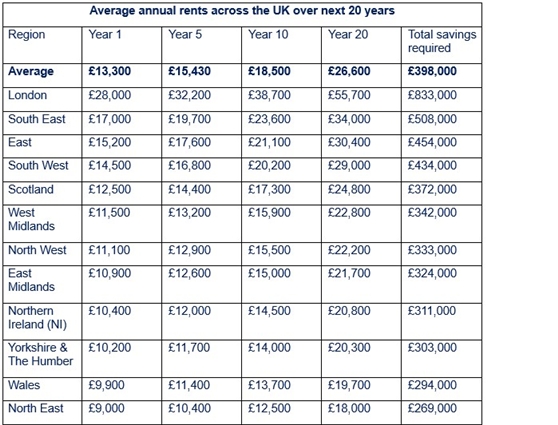

People who expect to rent during retirement could need an additional £398,000 in savings compared to those with no housing costs, according to new analysis by Standard Life, part of Phoenix Group. This is an increase of £7,000, with those renting in retirement needing £391,000 in 2024.

Standard Life’s analysis used Office for National Statistics (ONS) data to project rental costs over a 20-year retirement period, based on an average annual rent increase of 3.7% since 2015. While the real cost of living will vary due to factors including inflation and location, the analysis highlights the long-term financial implications of entering retirement as a tenant.

Regional divides in retirement rental costs continue

While year by year rental increases will depending on factors such as supply, inflation and interest rates, these figures give an indication of where it is more expensive to rent in retirement and reveal clear regional disparities. The southern regions, particularly London, the South East - consistently command the highest rent. In contrast, areas such as the North East, Wales and Northern Ireland offer less expensive rental options, highlighting a regional divide when it comes to housing costs.

For those approaching retirement, these figures highlight the importance of early financial planning. Renting in high-cost areas like London may require significantly more savings or pension income compared to more affordable regions

Figures are based on average life expectancy in retirement of 20 years and projected 3.7% annual rent increase. 3.7% has been estimated using monthly rental data available from Private rent and house prices, UK: May 2025. Figures rounded. Actual costs will vary by individual circumstances and inflationary trends.

Expectations vs reality of home ownership

Research by Standard Life on property and pensions shows that homeownership remains a key goal, with 40% of people planning to buy a property in the future. However, rising house prices continues to post a challenge. Latest ONS data shows that average UK house prices rose 6.4% over the past year, reaching £271,000 in March 2025, and for many, owning a home may remain out of reach. Standard Life’s Retirement Voice report also revealed that more than one-in-ten (12%) of adults expect to still be renting when they retire.

For these individuals, it is key to plan for housing costs in later life, particularly if using the Pensions and Lifetime Savings Association’s (PLSA) Retirement Living Standards. These are used widely to guide retirement planning and help people understand what kind of savings might be needed, but do not include housing costs.

There has also been recent debate about the possibility of allowing early access to pension savings for house deposits. While many people are drawn to the idea of using their pension savings to help fund a home purchase, there is strong awareness of the financial risks that this could present over the long term. Research from Standard Life reveals that nearly half (45%) of adults support the idea of accessing pension savings early to get on the property ladder. However a similar proportion (48%) acknowledge the long-term financial consequences of doing so. In addition, one-in-three say they would be willing to increase pension contributions if it meant improving their chances of buying a home – highlighting a willingness to balance short-term goals with long-term financial security.

Claire Altman, Managing Director at Standard Life, part of Phoenix Group, commented: “While saving more for retirement is increasingly essential, regardless of whether someone plans to rent or own, the reality is that for many, homeownership may no longer be feasible. For those who do expect to be renting in retirement, it will be important to start planning how they will meet these housing costs, especially if rent prices continue to increase, as seen in recent years.

“When planning for retirement, its crucial to consider how essential expenses like housing will be covered. If being mortgage-free is not an option, products like annuities, which offer a guaranteed income for life, may help ensure ongoing costs such as rent and essential bills are met.

“The steady rise in rental costs over the last decade highlights just how important it is for pension savings to keep pace. Financial resilience typically reduces later in life, so having a robust and well-planned income strategy becomes even more important. As the lines between housing and retirement become increasingly intertwined, it’s clear that a holistic approach is needed. For some, prioritising homeownership may be a key goal, while for others, focussing on building pension wealth will take precedence. The critical point is that both are long-term financial commitments which require careful planning. The industry, government and regulators all have a key role to play to support individuals in understanding how housing decisions, whether buying, renting, downsizing or relocating, can impact retirement outcomes.”

|