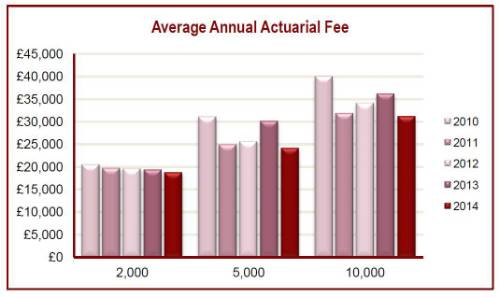

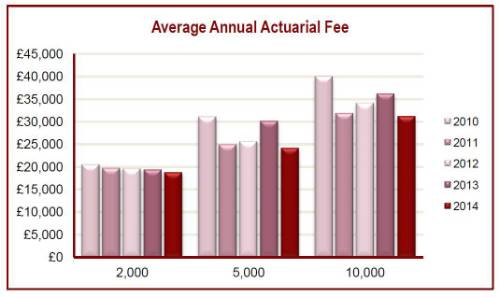

The fourth fee survey showed an upward trend in fees across scheme sizes, but was this due a popular valuation year having a knock on effect to everyday fees? Is it possible that changes following a valuation year effect ongoing fees?

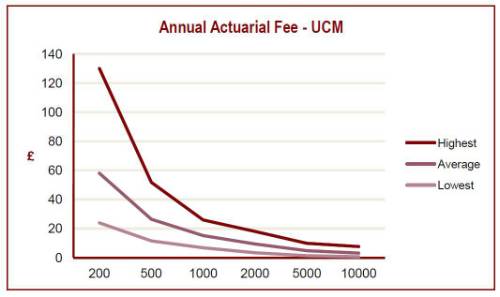

In recent years we have focused on the issue of Unit Cost per Member (UCM), i.e. taking the total costs and dividing them by the membership numbers. It came as little surprise that smaller schemes were paying a substantially higher UCM than the larger schemes. Our survey shows this trend continues.

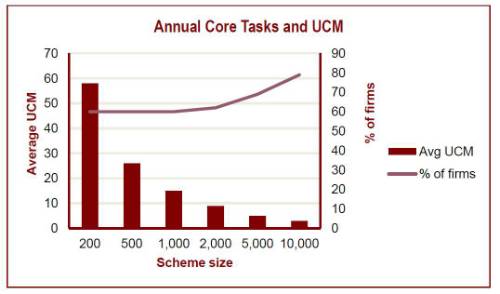

The KGC survey covers more than just fees, we look at how many firms provide a core set of tasks we expect to be included within their core fees. We questioned whether this differs depending upon the size of the scheme.

The findings showed that UCM fell as the scheme size grew and the percentage of firms providing all of the expected tasks also increased. This leaves small schemes paying more and in some cases they are getting less for their money.

Again this year we asked participants questions regarding the future and services required by schemes.

Hayley Mudge, Research Analyst and Report Author commented:

It comes as no surprise that de-risking remains top of the agenda for most schemes and actuarial firms continue to look for innovative ways of assisting them. Firms also expect additional work coming from advising schemes on the budget outcomes and new DC freedoms.

With regards to the issue of costs for smaller schemes, participants are looking to streamline costs through improving their use of technology and providing a much standardised range of services

Background to the survey

20 firms accepted KGC’s invitation to participate in our fifth Actuarial Fee Survey. We were pleased see the growing acceptance that the KGC surveys are now regarded as the leading source of data on fees and services in the industry. The survey data was collected via Survey Monkey™ where each firm was asked to provide a fee for a set of core services. Firms were given the opportunity to identify additional added value services which they normally include as core. To reflect the market, we asked the firms to cost for six different scheme sizes – 200, 500, 1,000, 2,000, 5,000 and 10,000 lives. Participating firms were asked to only complete fee information for scheme size they consider being within their core market.

KGC divided the main components1 within an actuarial service into six services these include:

-

Annual Actuarial

-

Triennial Actuarial Tasks

-

Ad hoc Actuarial

-

Periodic Actuarial

-

Triennial Valuation

-

Corporate

1 “based on experience derived from procurement and benchmarking exercises”

Each contact at the participating firm was asked to cost specific scenarios across the range of scheme sizes. No account was made for the asset size of each scheme.

The scenarios were as follows:

-

All scenario schemes are open to future accrual but closed to new members

-

Membership broken down – 25% active, 50% deferred and 25% pensioners.

-

There is one category of members – 1/60 accrual, contracted-out on reference scheme test, LPI pension increases, pensionable salary set at renewal on 01/04 and is basic salary exclusive of fluctuating emoluments.

Please note this will be the last fee survey based on the above scenarios, our next survey will change to reflect how the market is moving and look at a different, wider scope of services such as revenue from additional services.

|