By Frazer Morgan, Head of LDI Research, Ben Johnson, Senior Strategist and Graham McLean, Head of Scheme Funding, WTW

We encourage all stakeholders to reflect on the implications of their decisions in this context. In particular, when considering a buy-out or when thinking about the possible member upsides of run-on.

The UK's fiscal reality – and the inflation threat

If the UK's post-2008 low productivity growth of around 0.4% per annum continues, projections suggest the debt-to-GDP ratio could reach around 700% by 2075 as seen in Figure 1 below.

That level of debt is clearly unsustainable and in practice cannot happen, so it won't. However, it highlights the importance of considering a range of plausible outcomes and their possible causes. Advances in productivity, perhaps driven by AI, could lead to a safer trajectory. Alternatively, the UK might navigate through with a combination of higher taxes and lower spending. But history reminds us of another plausible and high impact path: inflation.

In more challenging scenarios, it may prove difficult to enact the tough measures needed to stabilise the fiscal outlook. This could increase the risk of a fiscal crisis, and while a full sovereign default remains unlikely, the UK could face significant financial strain – like episodes experienced by other advanced economies in the past. The UK's AA credit rating (as measured by S&P) implies a roughly 10% chance of default over 50 years[1], and there may be an even greater likelihood of a close call or "near miss".

Looking back at history, it is very common in these cases (and near misses) for there to be high inflation, as the debt burden is inflated away. The 1970s in the UK might act as an example that didn't quite result in a default. Analysis of countries that do default suggests that c700% cumulative inflation around the time of default is not uncommon (even excluding hyperinflation)[2].

Central banks have played a key role in keeping inflation under control in recent decades. However, they have not yet been tested under the kind of fiscal and political pressure that may emerge. In such environments, the balance between independence and political influence can become more delicate and inflation risks may rise as a result.

Understanding UK DB pension structures

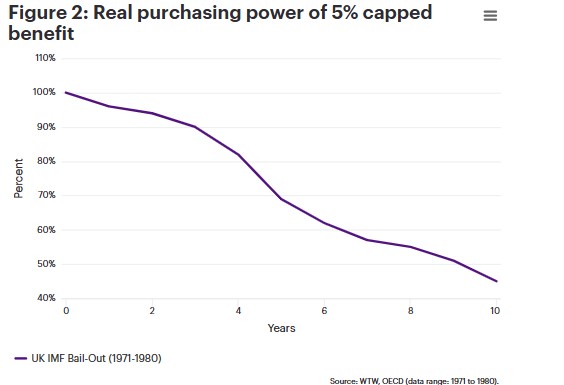

Most UK DB pensions include inflation protection, but with annual caps – typically at 5% or lower. In years of high inflation, these caps may limit the extent to which benefits keep pace with rising prices. For example, if inflation were to mirror levels seen in the 1970s, the real value of a £10K annual pension could decline significantly over a decade to just £4.5K in real terms (Figure 2).

These caps were originally introduced to manage the risk to sponsors during periods of high inflation – which was a current issue when guaranteed increases were introduced. However, with modern tools such as liability-driven investment (LDI) strategies and inflation-linked instruments, there is greater ability to manage these risks today and to better protect the real incomes of pensioners from the impact highlighted above without extra risk on sponsors.

Implications for trustees

Trustees are currently navigating two important decisions that could shape member outcomes:

Should the scheme pursue a buyout (with inflation caps on benefits)?

If a decision is made to run-on, how can surplus be used to enhance member outcomes?

Buyouts remove the option for discretionary increases (unless they are explicitly included at outset). In a high-inflation environment, this could reduce the real value of member benefits. Trustees may wish to consider whether this approach offers the most robust long-term protection to their membership.

Instead, opting to run on, with a focus on resilience, may provide opportunities to better support members. In this context, reviewing inflation caps should be a high priority for consideration. From a long-term perspective, and as shown in the chart below, the cost of such changes may be modest relative to the potential benefit for members.

Conclusion: It's time to "Get Real"

For many years, the pensions industry has equated "security" with meeting contractual obligations. But in a world of rising inflation and fiscal uncertainty that definition may no longer be sufficient.

True protection means preserving purchasing power. It means using surplus thoughtfully, reviewing caps where appropriate, and helping members retire with confidence and dignity.

Trustees have an opportunity to lead with foresight. To look beyond the familiar and consider what long-term value really means. It's time to "Get Real" about pensions and what they are for.

|