By Simon Bramwell, Principal and Head of Longevity Risk Transactions at Barnett Waddingham

The negative consequences for life expectancy of the pandemic, including Covid-19 itself, broader missed medical diagnoses, a volatile flu season, and the impact of austerity could have a significant impact on pension scheme liability values

The worst-case scenarios for life expectancy could see FTSE350 DB scheme’s time to buyout fall by up to a third, putting them on track to reach their endgame in March 2026, rather than the current estimation of October 2028

Trustees and companies should consider the potential impact of the change in mortality on their scheme’s journey plan and whether now is a good time to manage their longevity risk

By analysing mortality rates, pension schemes can estimate members’ future life expectancies and, accordingly, the value placed on the pension scheme liabilities in their scheme funding strategies. The outlook for future longevity remains difficult to predict due to uncertainty around how a number of key factors influenced by the pandemic are likely to play out over the next 5-10 years.

There could be multiple negative consequences for life expectancy following the pandemic. These include:

• A negative economic environment, including austerity and high unemployment, which will reduce standards of living

• Missed medical diagnoses and treatments during the pandemic

• Long-Covid and its symptoms

• The risk of vaccine-resistant strains of Covid-19

• An unusual 2021/22 winter influenza season, which may inhibit the effectiveness of next winter’s flu vaccine

However, there are also likely to be some positive consequences for life expectancy, with improved public hygiene, a stronger post-pandemic population, and further advances in medical science.

The impact of longevity on buyout

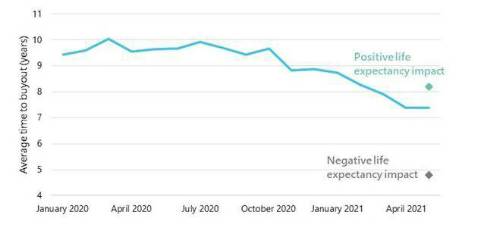

In the most negative modelled scenario of life expectancy, Barnett Waddingham predicts that within twelve months, the average time to buyout could fall from 7 years 5 months to 4 years 10 months, a fall of 35%. This would put FTSE350 schemes on track to reach endgame in March 2026, rather than October 2028.

In the most positive scenario where life expectancy increases significantly following the pandemic and there are no negative consequences, the time to buyout would be pushed up to 8 years 3 months, a 10 month increase to August 2029.

Realistically, the actual outcome will likely fall somewhere within this range:

Longevity risk

The strong recovery in financial markets means that the FTSE350 DB schemes’ journey to the endgame is now firmly back on course since the pandemic began. And if the negative scenario for life expectancy plays out, the insurance market will need to adjust its pricing accordingly, bringing endgame even closer. This is truest for schemes that have not assessed their buyout position in detail for some time but have subsequently seen significant funding level improvements due to positive investment performance, additional contributions, and a general slowdown in life expectancies prior to the pandemic.

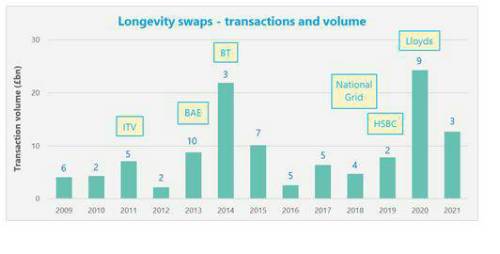

Longevity risk – that is, the impact of pension scheme members dying sooner or living longer than expected – is unrewarded: schemes are not expected to benefit from holding the risk, unlike investment risk. This emphasises the importance for companies to consider whether this risk should be hedged. A longevity swap could be an effective way to manage this risk, bringing more certainty regarding the path to buyout or forming an integral part of a self-sufficiency strategy. While longevity swaps have happened sporadically over the last decade, we are likely to see an increase in these contracts in the coming months, especially as contracts have become more flexible and can be converted into a buy-in/ buy-out in the longer term.

Simon Bramwell, Principal and Head of Longevity Risk Transactions at Barnett Waddingham, said: “The Covid-19 crisis caused severe disruption across the world economy, and the UK’s pension landscape was no exception. However, it seems that the worst is now behind us, and on a financial basis the Covid-19 funding gap appears to have been resolved – in fact, most schemes are in a better position than they were before the crisis.

“While the worst of the financial shockwaves has passed the longer term impact of the pandemic on our society, and the life expectancies of our population, is far from understood or certain. It is of course a sensitive subject, but trustees and companies must take these considerations into their journey plans if they hope to take strategic action and manage their funding positions.

Despite record volumes of pension de-risking activity in the last few years – with more than £100bn of UK DB pension scheme liabilities being transferred over 2019 and 2020 – there remains a substantial amount of DB pension scheme risk on FTSE350 company balance sheets. It now falls to schemes to de-risk accordingly and keep on a clear path to their endgame.”

For trustees and companies mapping the course of their DB pension schemes, Barnett Waddingham has launched a DB Navigator to offer a clear and simple decision-making framework to support on the journey.

|